Transfer Pricing Blog

What is a fiscal unity?

Albert Einstein and taxes Taxes has throughout the ages been a major point of debate. Every country has their unique way of collecting taxes. Leo Mattersdorf was the tax advisor for Albert Einstein. They once had lunch together where Einstein famously told Mattersdorf...

Convert Excel to Form 8975 Country-by-Country Report filing

TPGenie software is prepared to generate Country-by-Country Reporting Form 8975 and Schedules A (Form 8975), holding Tax Jurisdiction and Constituent Entity Information. You can use TPGenie to convert Excel to Form 8975 and bulk generate Form 8975 and Schedules A...

TPGenie + Public CbC

TPGenie is prepared to flag for Public Country by Country Reporting. Public CbC will be in place for the MNE groups. To determine if an MNE is flagged for Public CbC, TPGenie uses the below set of rules: EU headquartered MNE and in last 2 years revenue > 750mil, or...

How to perform a Transfer Pricing benchmarking study

Benchmarking study or comparability analysis is the heart of the application of the arm’s length principle. Application of the arm’s length principle is based on a comparison of the conditions in a controlled transaction with the conditions that would be applied...

ISO 27001 certification

Intra Pricing Solutions BV is in the process of ISO 27001 certification. The goal is to receive the certification by the end of 2022. What is ISO 27001 Certification? ISO 27001 is an internationally recognised specification for an Information Security Management...

Compare Transfer Pricing databases

Multinational enterprises across the globe have to comply with transfer pricing documentation requirements. To provide the documentation which is fully compliant with tax legislation it should contain the calculation of arm’s length range – comparability analysis. In...

Software update: Eastern Europe Transfer Pricing Benchmarking Database

As businesses continue to expand globally, transfer pricing has become an increasingly important topic for multinational enterprises. To assist companies in managing their transfer pricing policies, we have recently updated our transfer pricing software with a new...

What is a Transfer Pricing Policy template?

A transfer pricing policy template is a document that provides a framework for setting transfer pricing policies within an organization. Transfer pricing refers to the pricing of goods or services that are transferred between related parties, such as between different...

Benefits of using TPGenie and having an external tax advisor

When using TPGenie for creating local files for your MNE group entities, it could be that in some countries (for example India or China) you still have external tax advisors handling your transfer pricing documentation. How to deal with this in TPGenie? Is there a way...

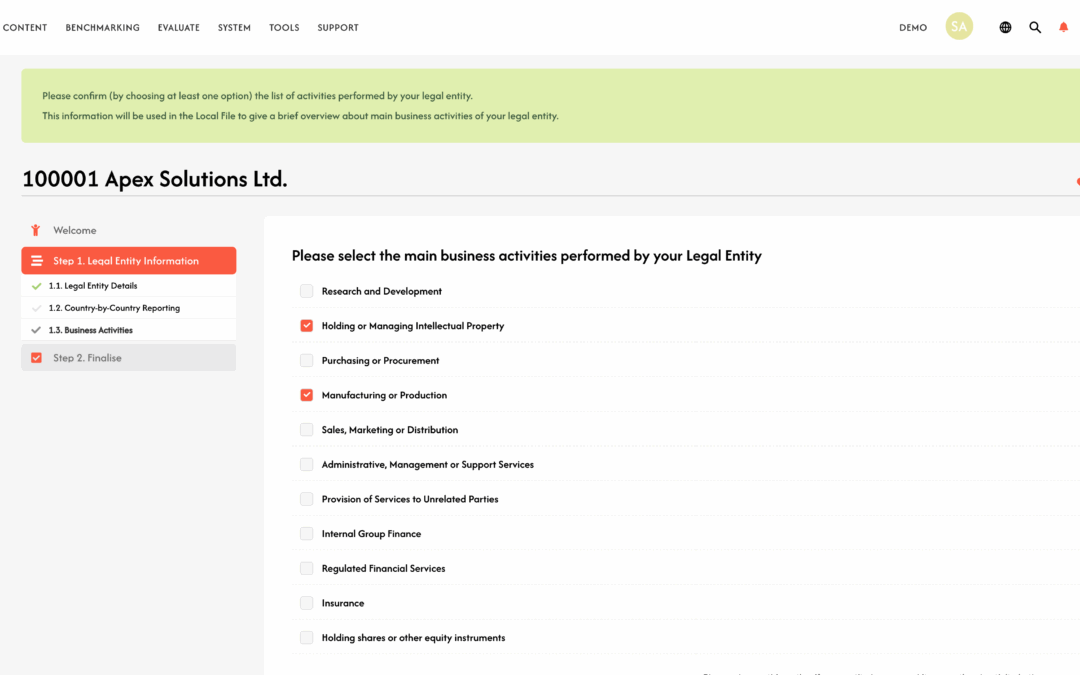

What is the CbCR Survey?

Don't waste your time on sending back and forth Excels and lots of emails! TPGenie transfer pricing software is equipped with the CbCR Survey. The CbCR Survey is easy to use workflow software that enables you to gather your local CbC data across your group entities....