Transfer Pricing Blog

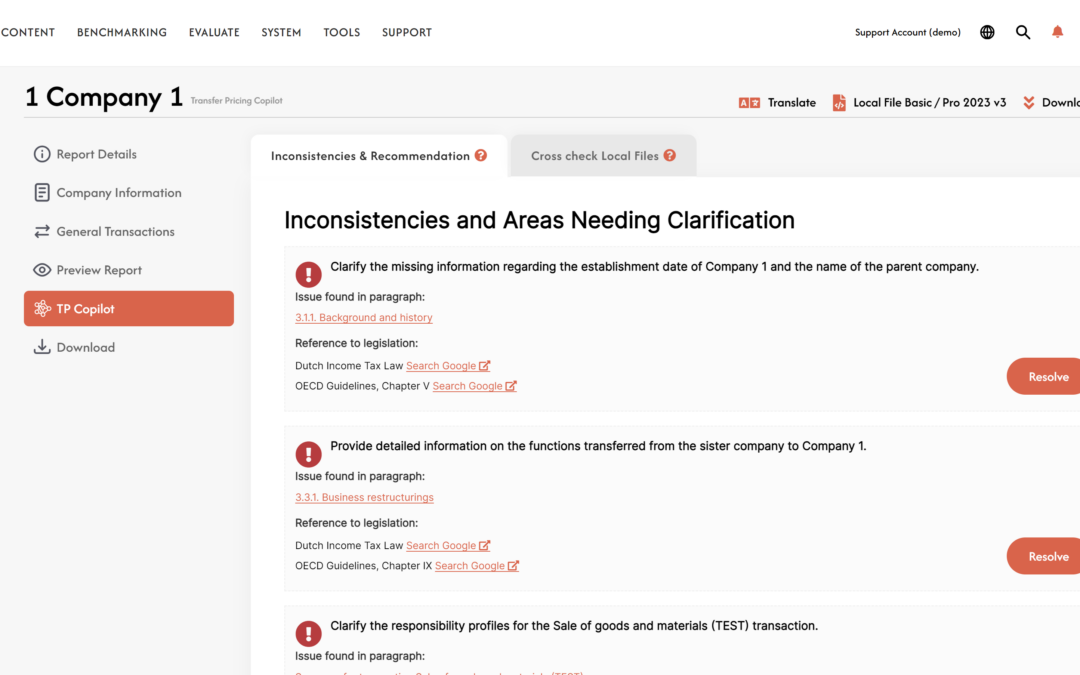

Introducing Transfer Pricing Copilot for TPGenie

We are proud to announce the release of TP Copilot, an AI-powered module now integrated into TPGenie, designed to check all documents generated by TPGenie thoroughly against the latest OECD Transfer Pricing Guidelines and local legislation. TP Copilot significantly...

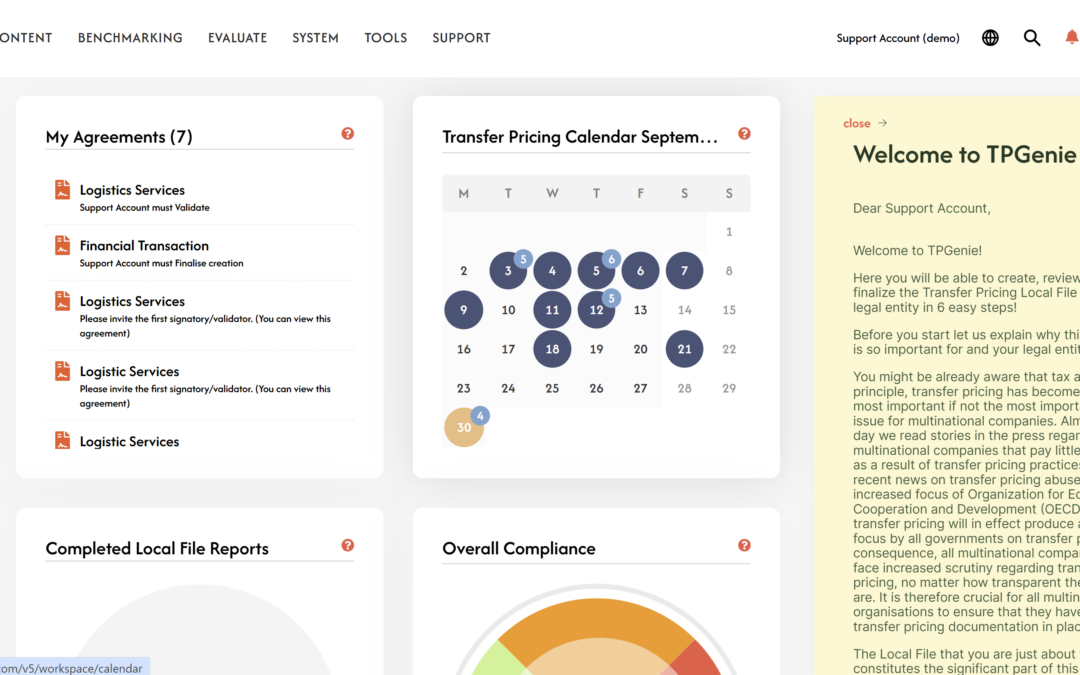

A Fresh New Look for TPGenie and Intra Pricing Solutions

Last month marked an exciting chapter for Intra Pricing Solutions and TPGenie, our flagship Transfer Pricing Documentation solution. After months of hard work by our whole team, we proudly unveiled a complete visual overhaul, introducing a fresh and modern design that...

Sustainability, ESG, and Transfer Pricing

As environmental, social, and governance (ESG) factors continue to gain prominence in the global business landscape, multinational enterprises (MNEs) are increasingly integrating sustainability into their core strategies. Transfer pricing plays a crucial role in...

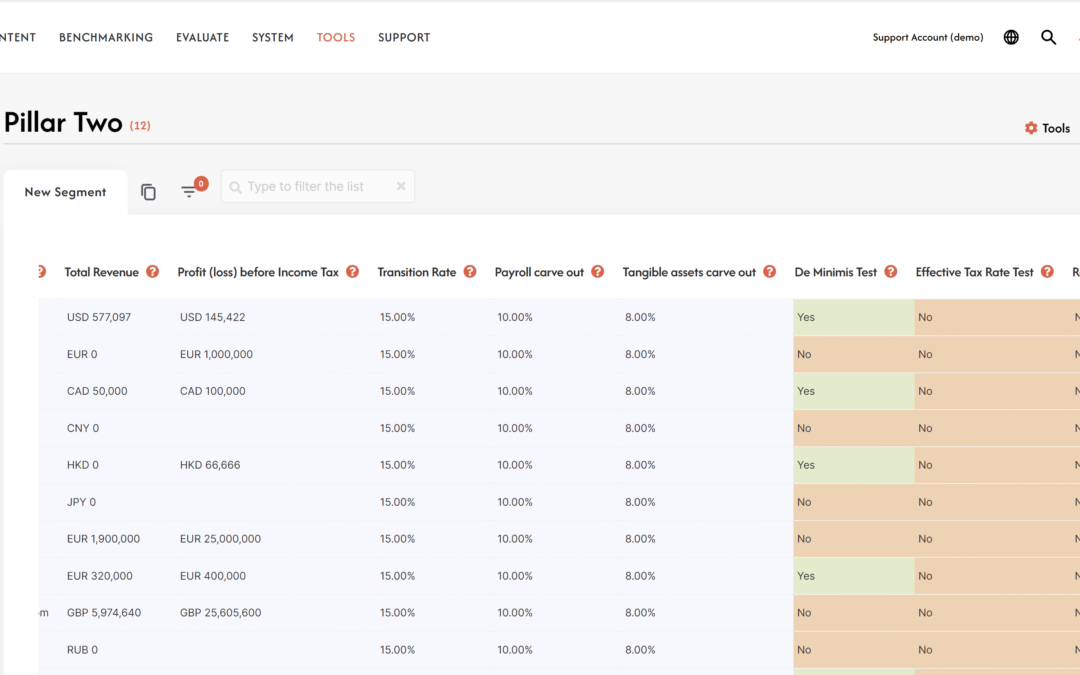

Understanding Pillar Two Software: A Key Tool for Global Tax Compliance

The Pillar Two regulations, part of the OECD’s Global Anti-Base Erosion (GloBE) framework, require multinational enterprises to calculate and report global tax liabilities. With this, the need for Pillar Two software has emerged, designed to streamline the process of...

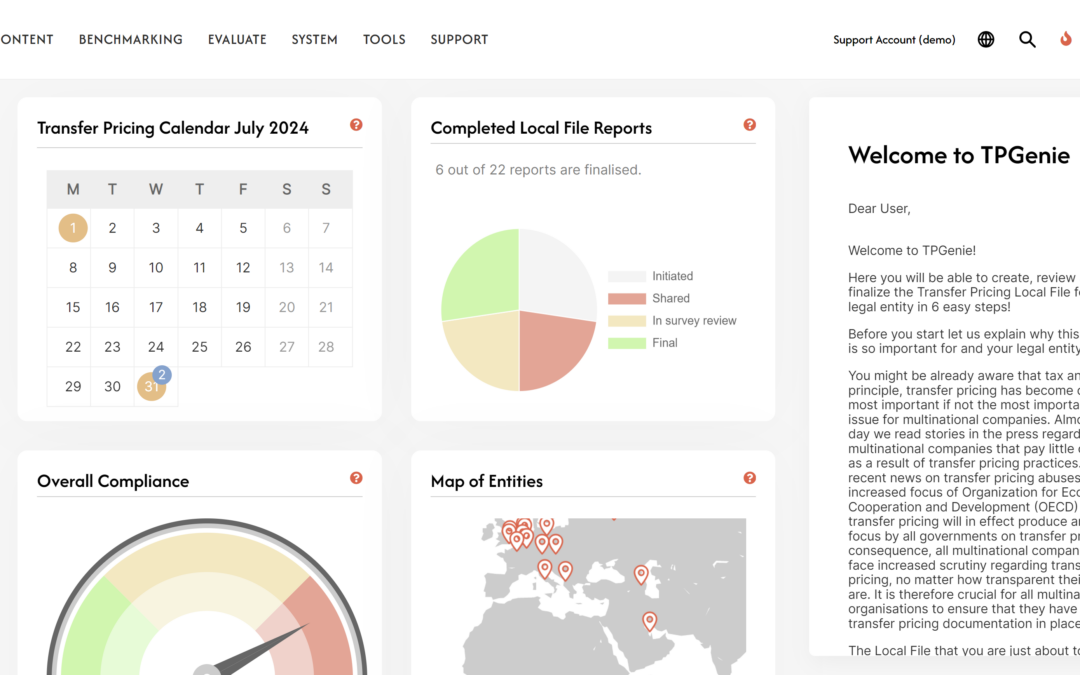

Unlocking Transfer Pricing Compliance: The power of the TPGenie compliance tracker tool

Compliance with transfer pricing regulations across multiple countries presents a complex challenge for organizations operating and planning to expand internationally. This requires careful navigation in understanding diverse regulatory landscapes and meeting all the...

The Integration of AI and LLMs into Transfer Pricing: Transforming Documentation, Benchmarking, and Risk Management

Over the last decade there has been a significant increase in the domain transfer pricing regulations and compliance requirements. The OECD’s Base Erosion and Profit Shifting (BEPS) initiative, have added layers of complexity, demanding more stringent documentation...

Transfer Pricing Documentation with TPGenie: The Leading Transfer Pricing SaaS Solution

Transfer pricing is one of the most critical tax issues faced by multinational enterprises (MNEs) today. As regulatory scrutiny intensifies worldwide, ensuring that your transfer pricing documentation is both accurate and compliant has never been more important. For...

Upcoming Design Update for TPGenie

In the coming month, TPGenie will undergo a significant visual update. After months of dedicated work, the team is ready to unveil a fresh design and new branding for TPGenie. This update aims to enhance user experience with a clearer, more modern interface. What’s...

TPGenie’s Next-Gen Interface

TPGenie, your trusted companion in writing and automating transfer pricing documentation, is ready for a transformative leap. After more than half a decade of steadfast service, our platform is evolving to meet the zeitgeist of the modern digital era. We're thrilled...

VIDEO: Revolutionise your transfer pricing benchmarking with TPGenie Benchmarking AI!

Say farewell to the time-consuming manual process and embrace a new era of precision and efficiency. Our AI-driven solution not only automates your benchmarking studies but provides an impressive 95% accuracy rate in filtering search results. Compatible with leading...