A professionally written local file is the key ingredient of your transfer pricing documentation. Whether you’re a CFO, transfer pricing manager or something in between, drafting a local file for your entity or group can be quite difficult. Transfer pricing local file requirements are described on the OECD website and you can find numerous great resources online on how to write a local file. Still, we get often the question about where and how to start. Therefore we are happy to share our knowledge and provide you with an example of the local file. Below you can download a free Transfer Pricing local file template sample. You can use this example as a starting point for drafting your transfer pricing documentation.

The most common parts of a high-quality local file are described in this article. However, to make it even more complex, many countries have regulations slightly deviating from OECD guidelines. Countries such as Russia, Poland, Italy, to name a few as well as many Latin countries all implemented their rules slightly differently. Writing a local file for those countries need further investigation on the local regulations.

Besides a local file, additional documentation is often required, such as benchmarks, Master File, Country-by-Country Reporting and intercompany agreements.

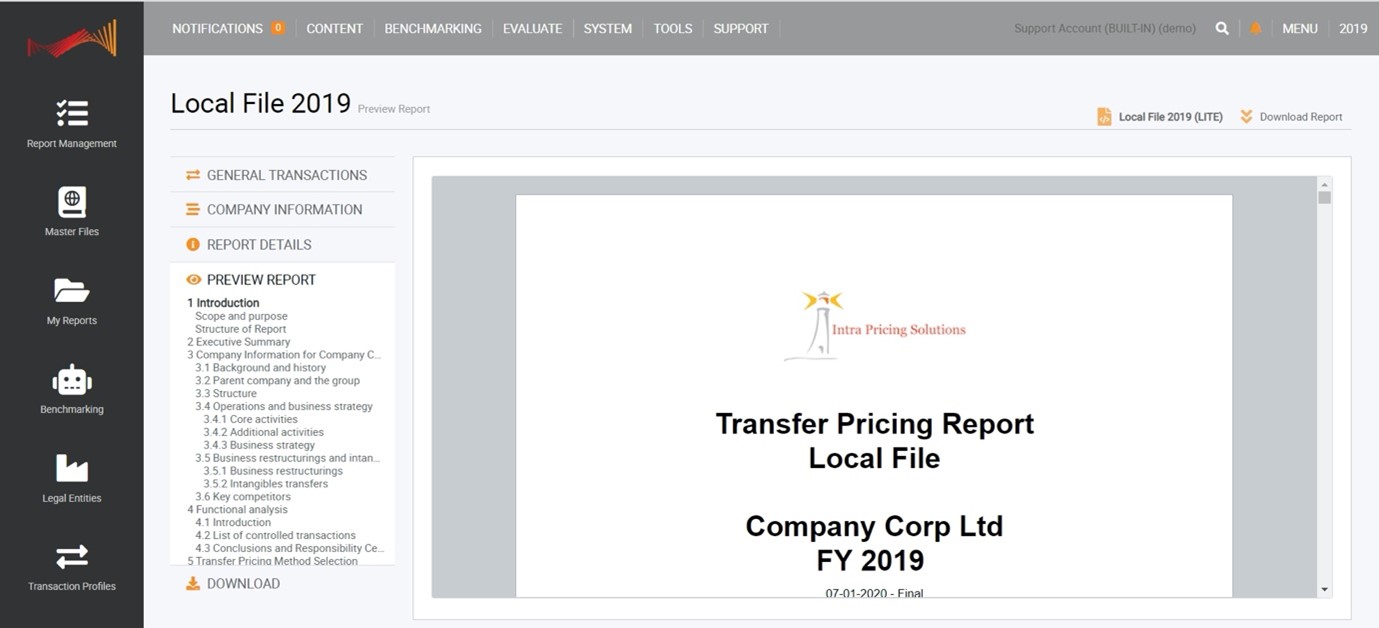

Below you can download a table of contents transfer pricing local file in the format the OECD describes. The file is generated with our software solution TPGenie Basic. The structure is an example for an entity named [Company] and has four intercompany transactions included. The free Transfer Pricing documentation sample can be downloaded below.

Table Of Contents

- Abbreviations

- 1 Introduction

- Scope and purpose

- Structure of the report

- 2 Executive Summary

- Summary for transaction Sale of goods and materials

- Summary for transaction Provision of Services

- Summary for transaction Licensing of intellectual property

- Summary for transaction Financial Transaction

- 3 Company Information for [Company]

- 3.1 Background and history

- 3.2 Parent company and the group

- 3.3 Structure

- 3.4 Operations and business strategy

- 3.4.1 Core activities

- 3.4.2 Additional activities

- 3.4.3 Business strategy

- 3.4.3.1 Business restructurings and intangible transfers

- 3.4.3.1.1 Business restructurings

- 3.4.3.1.2 Intangibles transfers

- 3.4.3.1 Business restructurings and intangible transfers

- 3.5 Key competitors

- 4 Functional analysis

- 4.1 Introduction

- 4.2 List of controlled transactions

- 4.2.1 Analysis for Sale of goods and materials

- 4.2.1.1 Functions

- Production

- Sales

- Marketing

- Research & development

- Engineering

- Procurement

- Project planning

- Quality control

- Transportation/Logistics

- Warehousing

- Treasury

- Other

- 4.2.1.2 Risks

- Currency risk

- Product Liability

- Warranty

- Production Delay

- Market

- Inventory

- Foreign Exchange

- Credit

- Capacity

- Environmental

- Reputation

- Regulatory

- Other

- 4.2.1.3 Assets

- Production related tangible assets

- Production related intangible assets

- Trade-related tangible assets

- Trade-related intangible assets

- Marketing intangibles

- Raw materials

- Other

- 4.2.1.1 Functions

- 4.2.2 Analysis for Provision of Services

- …

- 4.2.3 Analysis for Licensing of intellectual property

- …

- 4.2.4 Analysis for Financial Transaction

- …

- 4.2.1 Analysis for Sale of goods and materials

- 4.3 Conclusions and Responsibility Centre Profiles

- 4.3.1 Analysis for Sale of goods and materials

- 4.3.2 Analysis for Provision of Services

- 4.3.3 Analysis for Licensing of intellectual property

- 4.3.4 Analysis for Financial Transaction

- 5 Transfer Pricing Method Selection

- 5.1 Introduction

- 5.2 Method selection for Sale of goods and materials

- 5.3 Method selection for Provision of Services

- 5.4 Method selection for Licensing of intellectual property

- 5.5 Method selection for Financial Transaction

- 6 Economic Analysis

- 6.1 Introduction

- 6.2 Economic Analysis for Sale of goods and materials

- Benchmarking Write-up Comparable Companies

- 6.3 Economic Analysis for Provision of Services

- 6.4 Economic Analysis for Licensing of intellectual property

- 6.5 Economic Analysis for Financial Transaction

- Appendix 1: [Company]’s Documents relevant to the Local file

- Appendix 2: OECD References

- Appendix 3: Economic Analysis

- Appendix 4: Country references

- The Netherlands

- …

Download:

Transfer Pricing documentation local file sample

TPGenie helps you generating a local file for your entity(ies) in a few easy steps and includes tools for assisting you in writing your local file, including:

- Free local file templates included.

- Easy 4 step process of creating local files.

- Automated functional analysis method selection and risk analysis.

- Transfer Pricing Guide with country-related regulations, deadlines and resources included.

- Benchmark databases included.

TPGenie offers loads of features, so instead of writing the local file by hand TPGenie Basic can save you a lot of time and headaches!

Recent Comments