TPGenie Business

Transfer Pricing documentation & client management tool for Tax Advisors & Transfer Pricing Services Providers

- 10 users

- Unlimited entities and countries

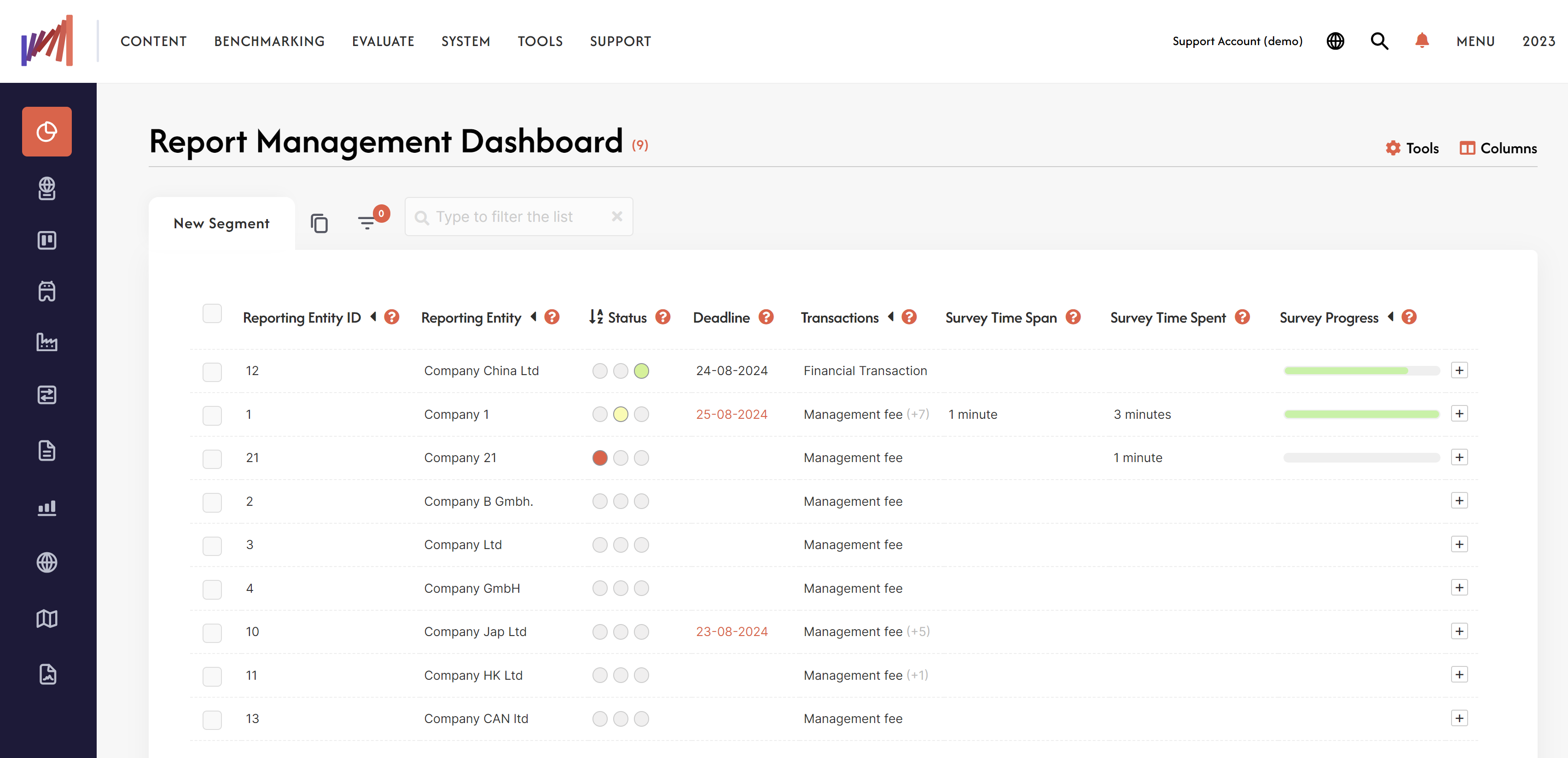

- Client management dashboard

- Transfer pricing benchmarking databases

- Free country references

- TP Calendar and notifications

Work together with your TP team to create and manage Transfer Pricing documentation for your clients.

TPGenie Business is transfer pricing documentation software for tax advisors. It is specially designed to accommodate the needs of transfer pricing services providers such as independent transfer pricing specialists, trusts, consultants and accountants. It is an easy to use web-based transfer pricing documentation and management suite. This genius solution helps you and your team to efficiently create, manage and update compliant transfer pricing documentation for your clients, including Local File, Master File and Country-by-Country Reporting.

TPGenie Business: Transfer Pricing documentation software for tax advisors

- Create & manage fully compliant TP documentation for your clients.

- Document management and workflow. It is easy to share and delegate documents and tasks with your colleagues or your clients using the incorporated status & messaging system.

- Audit trail enables you to track any changes made by you and your colleagues, review it and accept it or reject it.

- Easy integration of your existing corporate style documents and best practices (text) libraries, eliminating the need for copy/paste from older documents that may lead to mistakes.

- Dynamic text templates: you are not limited to a static format which generates hundreds of pages. You can create your own template up to your needs and even whitelabel the software and documentation.

- Pixel perfect document formatting to create reports that match your branding and styles.

- Intuitive and easy to use – even junior consultants can achieve the same quality of deliverables as expected from more experienced professionals such as senior managers and partners.

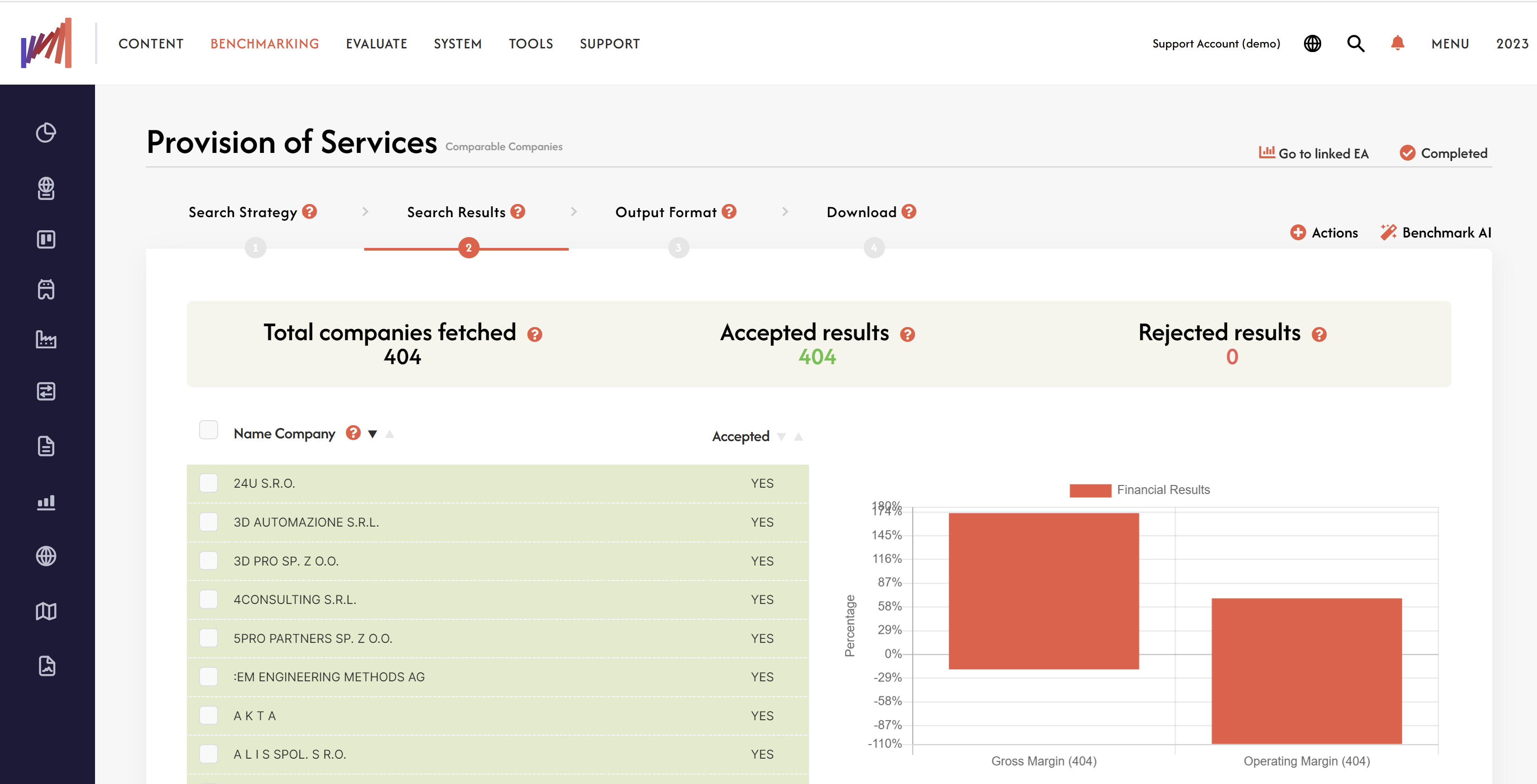

Benchmarking databases included

TPGenie Basic takes the complicated process of performing an economic analysis off your hands. It provides high quality benchmarking studies in few easy steps. It simplifies transfer pricing analyses, including profit and transaction-based analyses. The results can be directly included in your Local File. All underlying comparable companies or agreements were thoroughly checked by our experts, so you do not have to perform this labour-intensive exercise.

Here you can find more information on our benchmarking databases

Partner Program

As a tax advisor or independant transfer pricing specialist, you can become a TPGenie partner. You will immediately gain access to software, education, and marketing support – not to mention the value you can pass on to your clients. We’ll help you grow to earn even more.

The TPGenie partner program rewards you with a range of benefits that you can tailor to your own practice goals. We’ve created it to make you even more successful – no matter what success means to you.

TPGenie Modules

We provide direct tax solutions that are tailored to serve the industry to the fullest extent possible.