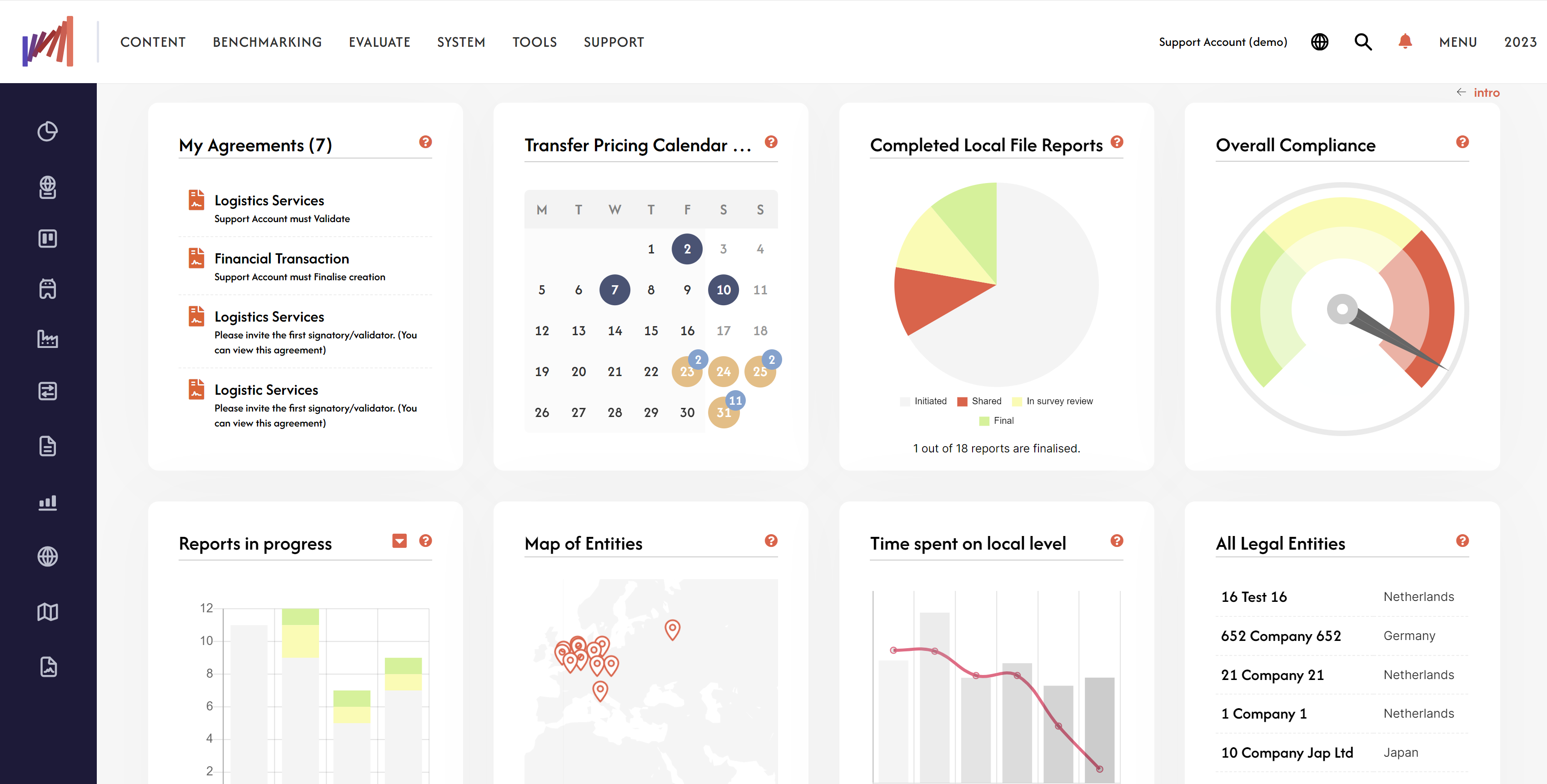

TPGenie Enterprise

Transfer Pricing Documentation Software

for multinationals

- Unlimited users

- Unlimited entities and countries

- Workflow

- Free country references

- TP Calendar and notifications

Create Transfer Pricing documentation for your whole group. Work either centrally or locally.

You are undoubtedly aware that transfer pricing has become one of the most important if not the most critical tax issue for multinational organisations. No matter how transparent the practices of a group are, the increased focus by all governments on transfer pricing increases scrutiny and possible audits. It is therefore crucial for all multinationals to ensure that they have proper transfer pricing documentation such as Master file and Local Files in place.

For many, it is a struggle to compile TP documentation because of its complexity. In general, many employees and legal entities across the world are involved in the process, while locally transfer pricing is unfortunately often viewed as a lesser priority. On a practical level, we have seen organisations struggle with the uncontrollable amount of Word-files sent back and forth, excerpts from TP documentation manually being copy-pasted and shared via e-mail. This results in a high risk of non-compliance and not having all documents centrally in place in case of an audit.

That is what sparked us to provide a solution to limit the time being spent on documentation preparation, making it easier for you to meet the compliance obligation. It is a user-friendly tool that will guide you through all the steps to finalise the transfer pricing documentation.

Our software solution TPGenie Enterprise helps you in a few easy steps to finalise your OECD compliant Master File and Local Files. The files will be automatically generated including all the necessary attachments: e.g. intercompany legal agreements and economic analysis/benchmarks.

The tool efficiently creates and updates OECD or country-specific compliant transfer pricing documentation for all legal entities in your group and assists you with transfer pricing planning, risk management and control.

Key features

- Create & Manage fully compliant TP documentation.

- Having all your Master files, Local Files, Intercompany Agreements and Economic Analysis Benchmarks for all your Legal Entities centrally available. When tax authorities request your Transfer Pricing documents, you will have all necessary data available within one click of a button.

- TPGenie was built in order to reduce the time you spend locally on documentation preparation and to make it easier for you to meet the OECD and local compliance obligation.

- Document management and workflow. Easy to share and delegate documents and tasks with colleagues using the incorporated status, messaging system and Audit Trail.

- Easy incorporation of your existing TP documentation.

- Pixel perfect document formatting to create reports that match your branding and styles.

- Dynamic text templates: you are not limited to a static format which generates hundreds of pages. You can create your own template up to your needs.

- Transfer Pricing Risk Management and Control.

- Many prefilled libraries are available. For example, a Sample Text Library providing standard texts that could be used to describe specific functions or risks within multinational.

- Unification of the templates reduce the risk of mistakes and increases consistency over the full documentation.

- Extensive help functionality, intuitive and easy to maintain, manage and update.

TPGenie Modules

We provide direct tax solutions that are tailored to serve the industry to the fullest extent possible.