Transfer Pricing Blog

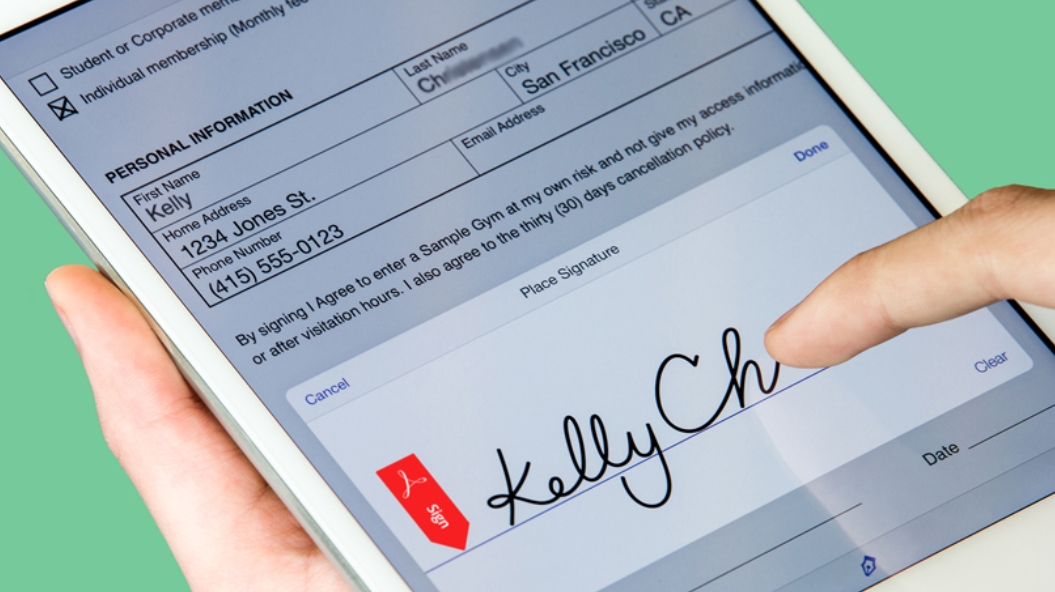

Adobe Sign API integration

Last months, we worked hard to integrate Adobe Sign capabilities into the TPGenie Intercompany Agreement Creation Module. The new integration substitutes the TPGenie Agreement workflow and uses the Adobe Sign process for adding e-Signatures to your intercompany...

Intercompany agreements: the relevance explained

A multinational entity (MNE) has its companies and activities located in (several) different countries. These ‘group companies’ often provide each other with goods and services within the MNE. However, national and international rules in the field of transfer pricing...

Download free Transfer Pricing Local File template

A professionally written local file is the key ingredient of your transfer pricing documentation. Whether you’re a CFO, transfer pricing manager or something in between, drafting a local file for your entity or group can be quite difficult. Transfer pricing local file...

How to create compliant transfer pricing documentation?

A common question for transfer pricing advisors from their clients is: “How do I create compliant transfer pricing documentation?”. The answer to this question is dependent on many facts. For example, the jurisdiction that is or jurisdictions that are applicable. Some...

Country-by-Country Reporting corrections

In case your group or client has updated Country-by-Country Reporting (CbCR) information, a CbCR correction should be made. A reason for making a correction could be for example due to changes in the financial figures (Table 1), entity details (Table 2) or updates in...

Overview of CbCR tax portal per country

TPGenie has powerful Country-by-Country Reporting features and CbCr services. Apart from features such as CbC data gathering, risk analysis based on KPIs and generation of CbCR XML, the software also directs you to the relevant tax authorities website for submission...

Compare Transfer Pricing software: static vs. dynamic documentation

When you are looking for purchasing the best transfer pricing software for your company, there are many considerations in making the right decision. When you compare transfer pricing software, one of the very important points to consider is to understand how much you...

What if CbCR conversion software didn’t exist? Manual steps to create a CbCR filing.

If you are responsible for performing the Country-by-Country Reporting for your group or as a tax advisor for your clients, you probably know that compiling your CbCR documentation can be quite a challenge. What many people don't know is that the technical part of...

Translate your transfer pricing documentation automatically

In many countries it is required to submit your Transfer Pricing documentation in a local language. This article provides you an overview of in which language countries require to submit Transfer Pricing documentation. Often it is required to translate Transfer...

Reporting Fiscal Unity and Local figures

TPGenie was already for years equipped with functionality that allows reporting a fiscal unity (fiscale eenheid in Dutch) accurately. In our most recent software update of May 2020, we have improved the functionality to make it more versatile to the needs of various...

Contact Us

Intra Pricing Solutions

Your guide in the world of Transfer Pricing

Herengracht 30

1015 BL, Amsterdam