Transfer Pricing Blog

Transfer pricing and interest rate changes in real estate

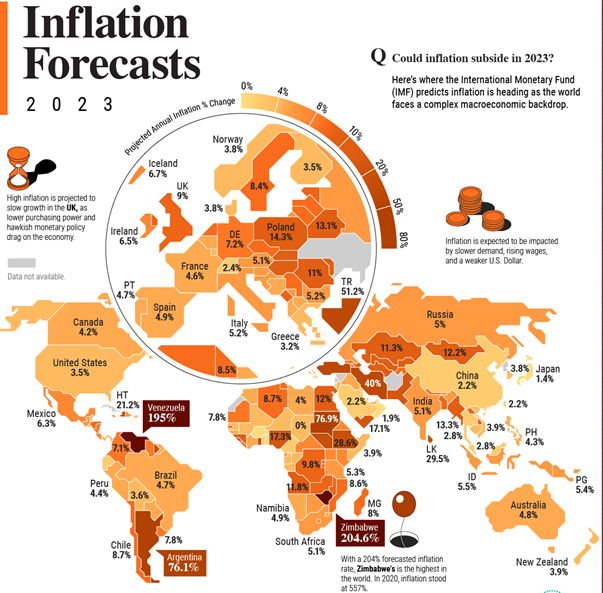

Inflation has been on an upward curve over the last few years and most central banks have followed with changing the monetary policy. The recent surges in interest rates and the volatility in the financial markets have changed the risk equation. This volatility causes...

An effective way to deal with the changes in transfer pricing regulations in the UAE

In the beginning of 2022, the Ministry of Finance (MoF) of the United Arab Emirates declared that they would introduce Federal Corporate Tax (CT) on business profit. These changes were implemented in the financial year staring 1 June 2023. Traditionally the UAE tax...

Streamline Transfer Pricing Compliance with TPGenie: A Solution for Brazilian MNEs

As a CFO or Global Head of Tax or Transfer Pricing expert working in a Brazilian multinational enterprise (MNE), you are likely aware of the challenges posed by transfer pricing regulations in Brazil. However, recent developments offer a glimmer of hope. The Brazilian...

Approaching the challenges of transfer pricing in an effective manner

Transfer pricing is undoubtably a key focus area in the international business community. Supply chain transformation, trade wars and regionalisation have created growing tax complexities. Multinational companies of all sizes need to constantly take steps to ensure...

Your multinational enterprise’s (MNE’s) transfer pricing documentation strategy: Centralised vs Local approach

In the past three decades, multinational companies have experienced no business function that grinds so deeply into all international operations as transfer pricing. Strategic decisions on transfer pricing have a large-scale impact on foreign operations of MNC’s,...

A productive way to increase your turnover as a tax-advisor

Tax advisors can create transfer pricing documentation for their clients. By doing this they could add an additional service to the business that might unlock doors for future growth. Here are a few reasons why you can consider taking this route and some practical...

What is Tax Tech and how does TPGenie fit in?

As of late tax technology have increased functionality and reporting capabilities for companies. These tax specific systems deliver a variety of methods to automate processes that brings many benefits. TPGenie from Intra Pricing Solutions offers companies a tax...

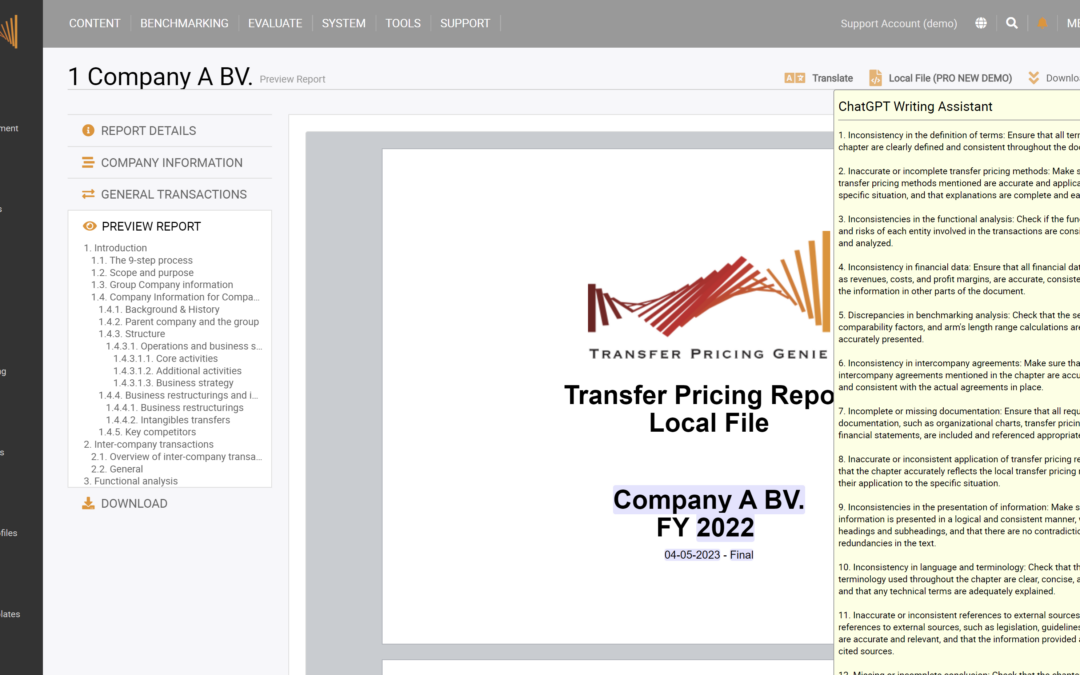

Revolutionizing Transfer Pricing Documentation: TPGenie Launches AI Writing Assistant with ChatGPT Integration

TPGenie, the innovative transfer pricing documentation tool, has just launched a game-changing feature: an AI writing assistant powered by ChatGPT. With this integration, TPGenie users now have access to an unparalleled level of writing assistance to help them...

Things to consider when purchasing transfer pricing software

When purchasing a transfer pricing documentation tool, there are several important success factors to consider. Reliability and accuracy The tool should provide accurate and reliable results. The calculations should be based on the latest transfer pricing rules and...

What is transfer pricing?

Transfer pricing (TP) encompasses the rules and conditions that dictate transactions within a Multinational Enterprise (MNEs). Primarily it concerns the inter-company prices charged between associated enterprises in different jurisdictions. Therefore, transfer prices...