Transfer Pricing Blog

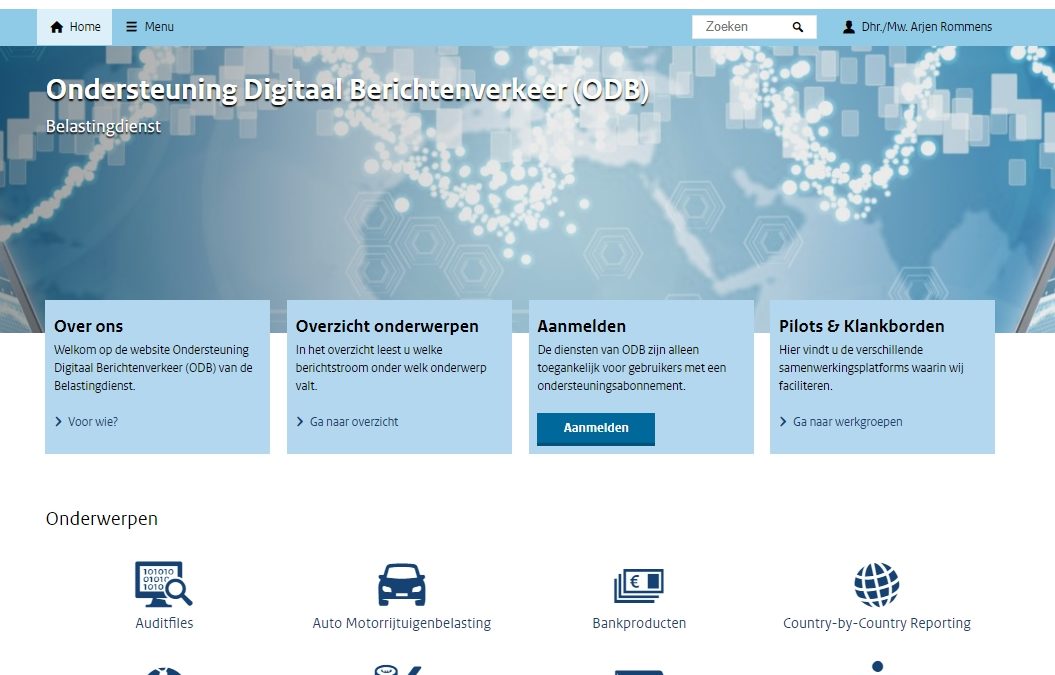

Dutch Country-by-Country Reporting specifications v4.0

On April 21th 2021 the Dutch Tax Authorities released an update of specifications in the Country-by-Country Reporting Guide, version 4.0. The overview includes new specifications and updated XML schemas for the Dutch CbCR XML delivery. From August 4th 2021 it is only...

Attribution of profits to a permanent establishment

Transfer pricing with respect to permanent establishments deserves separate attention. Whereas the OECD guidelines are primarily aimed at transactions between legal entities, the allocation of profits to permanent establishments requires a different approach. Here it...

Public Country-by-Country Reporting

As of June 1, 2021, a new phenomenon came to stage: Public Country-by-Country Reporting. The key difference under this new regime is that much of the information from the CbC-reports would now become publicly available on the company’s website and on a central...

Transfer Pricing Basics: How to set the correct transfer price?

For a number of years now, tax authorities have been paying increasing attention to transfer pricing. But, how to set the correct transfer price? Transfer pricing involves determining arm's length transfer prices for transactions between related entities. In other...

Software update: IAM integration for TPGenie

TPGenie has been updated with Identity Access Management (IAM) features. IAM, also known as identity and access management (IAM or IdAM) is a framework of policies and technologies for ensuring that the right users (in an enterprise) have the appropriate access to...

What is operational transfer pricing?

For many MNEs, transfer pricing is one of the major tax risks. This is because if an MNE and the tax authorities cannot agree on the arm's length price, this can result in fines or disputes. This is not only bad for the company's finances but also for its reputation....

What is the arm’s length principle?

Multinationals carry out activities in various countries with the aim of making a profit. The shareholders of multinationals are interested in the total, consolidated profit of the group in which they hold their shares. Where exactly this profit originates is...

What is transfer pricing documentation?

In this article we will explain what transfer pricing documentation entails. First, we will explain why you need transfer pricing documentation. Then we will briefly discuss the three different documents that are required. Finally, we will look at some other key...

Business restructurings and transfer pricing

Multinational entities are able to optimise their profitability by restructuring functions, assets and risks. These are business restructurings in which specialisation and rationalisation are aimed at making operations more efficient. In this way, an attempt is made...

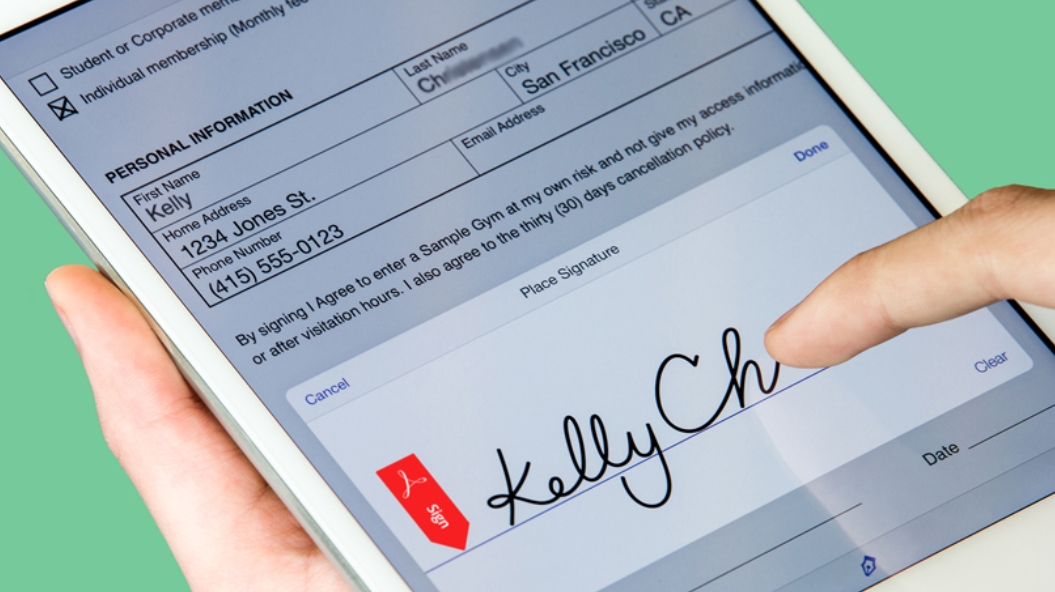

Adobe Sign API integration

Last months, we worked hard to integrate Adobe Sign capabilities into the TPGenie Intercompany Agreement Creation Module. The new integration substitutes the TPGenie Agreement workflow and uses the Adobe Sign process for adding e-Signatures to your intercompany...