Transfer Pricing Blog

Results of automating Transfer Pricing Benchmarking using Artificial Intelligence (AI): 95% accuracy!

Enter TPGenie Benchmarking AI, a solution that is revolutionizing how transfer pricing experts approach their benchmarking studies, enhancing accuracy, efficiency, and turnaround time for completing your transfer pricing benchmarking studies. 95% Accuracy in AI...

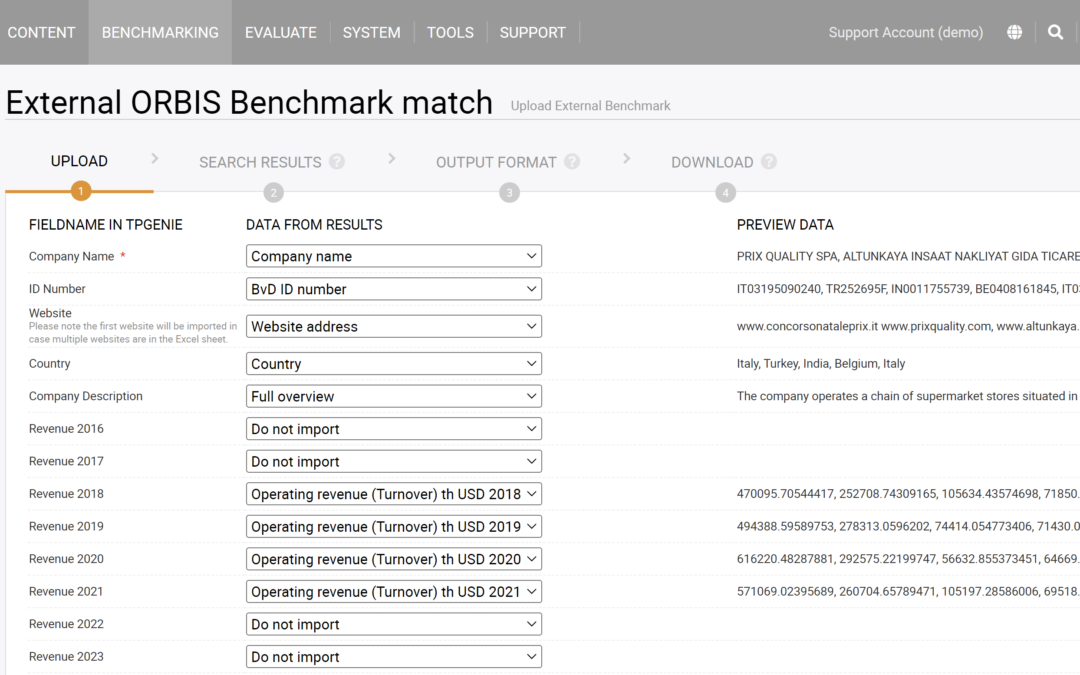

New feature: Upload External Benchmark

TPGenie introduces the Upload External Benchmark feature, streamlining the process of importing and analysing transfer pricing benchmark data. This new tool facilitates a more efficient workflow by allowing users to easily upload their data extracts and select the...

Streamlining Transfer Pricing Documentation with TPGenie: A Future-Proof Solution for Tax Managers and Experts

In the realm of transfer pricing, the challenges of standardisation and automation are paramount. With the introduction of TPGenie, a cutting-edge software designed to automate and standardise transfer pricing documentation, these challenges are not only met but...

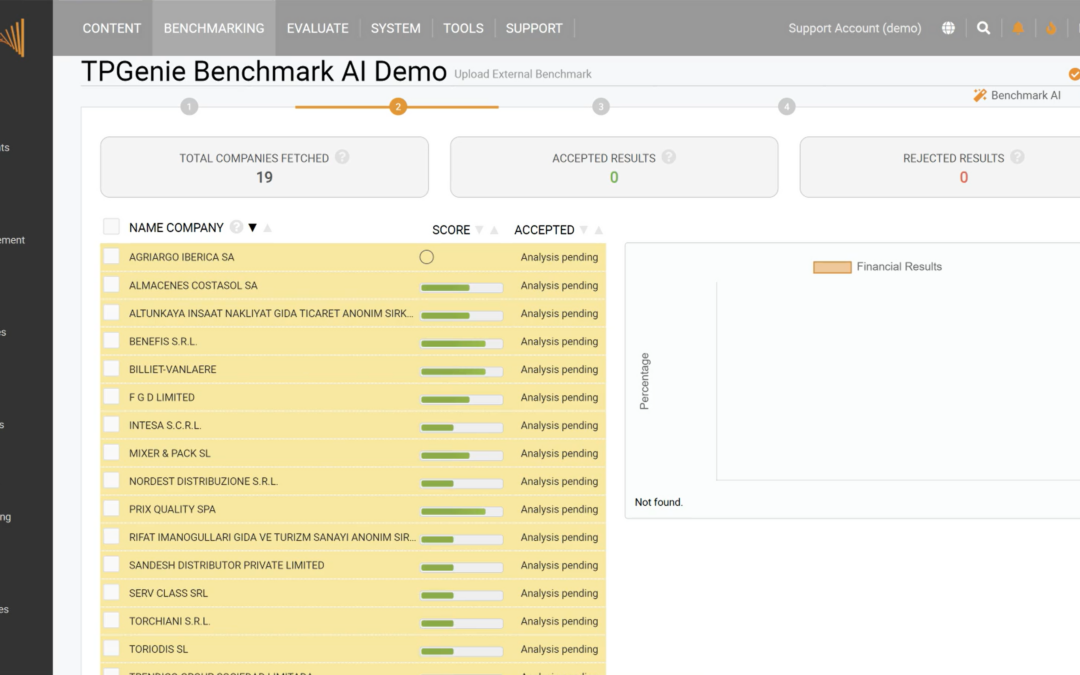

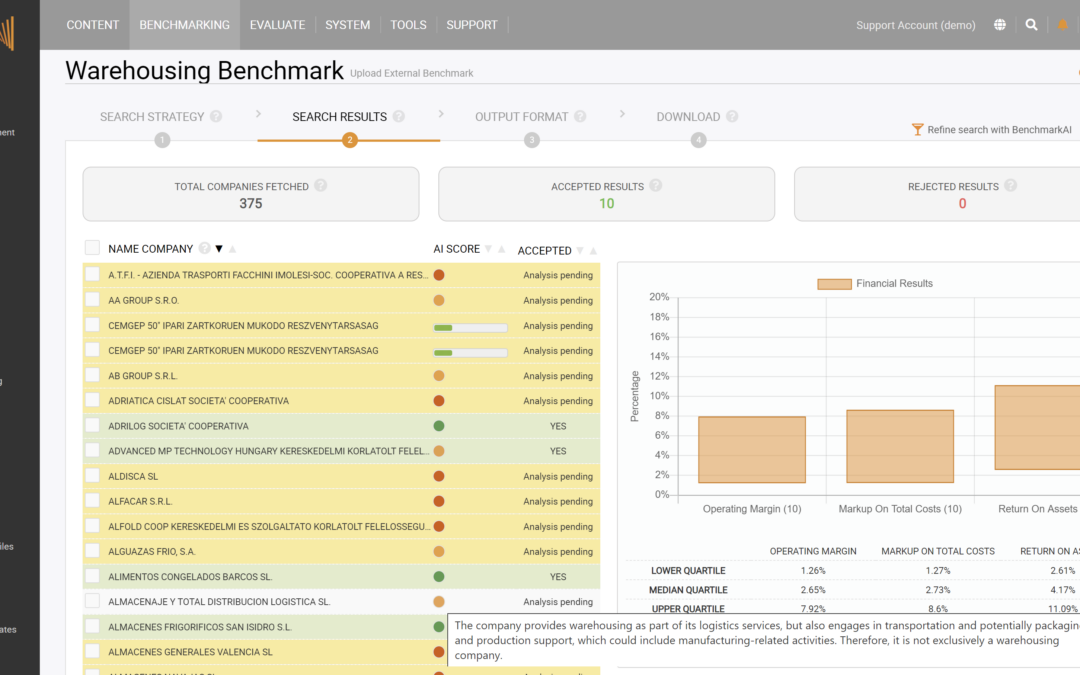

Boost Your Transfer Pricing Benchmarking: TPGenie’s BenchmarkAI-Powered Solution Saves Time and Delivers Precise Results

Supercharge your transfer pricing benchmarking with TPGenie's latest features: BenchmarkAI, our cutting-edge AI technology driven by OpenAI's ChatGPT revolutionizes the benchmarking process, saving you valuable time and ensuring precise results. Whether you prefer...

A solution for the new transfer pricing regulations in Moldova

In December 2022, The Republic of Moldova officially implemented its inaugural transfer pricing regulations, marking a significant development for businesses operating within the country. These regulations have been crafted in accordance with the guidelines set forth...

Newest trends in the transfer pricing world

The transfer pricing world is constantly evolving. The pace of change in the transfer pricing world appears to be accelerating because of commercial globalization and the OECD’s Base Erosion and Profit Sharing (BEPS) initiative. There are also growing resource...

An increased focus on Transfer Pricing audits

As transfer pricing-related tax audits become more prevalent, multinational companies (MNE’s) are facing heightened scrutiny in maintaining comprehensive audit trails for their financials and transfer pricing documentation. This surge in audits can be attributed to...

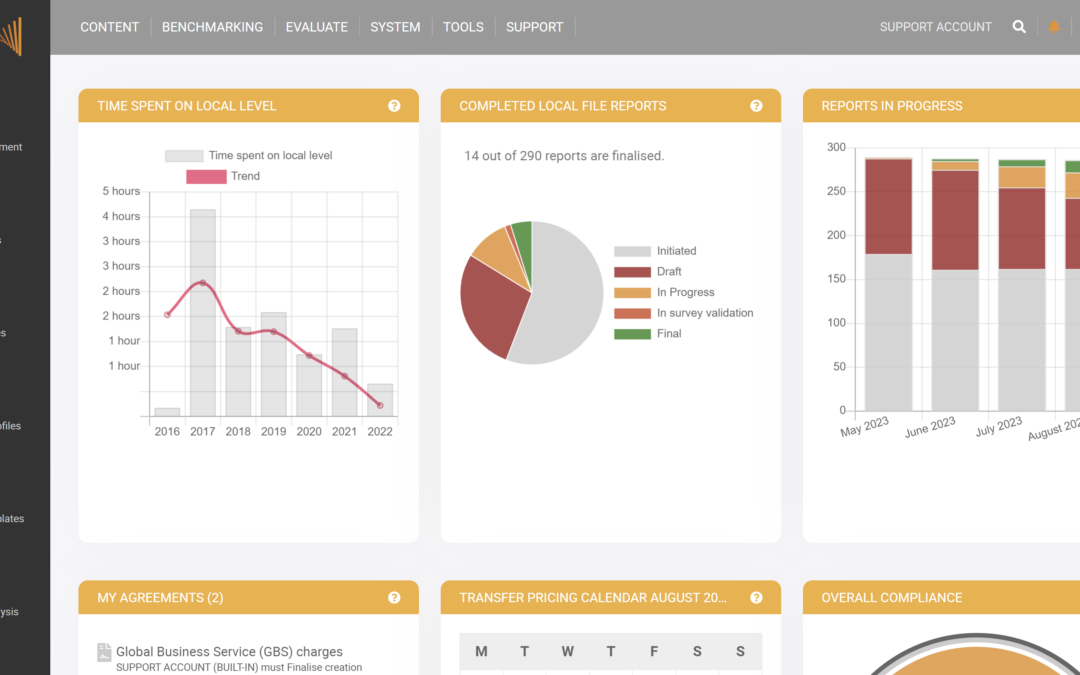

Optimizing Your TP Documentation Process: Introducing TPGenie’s Time Comparison Graph!

In today's fast-paced business world, time is a valuable resource. We've been diligently observing our users and are delighted to share that our clients have reported spending over 50% less time on Transfer Pricing documentation over a period of three years by using...

Download free Transfer pricing policy template

A polished and professionally drafted transfer pricing policy document is a key ingredient in your compliance process. This could be a difficult process no matter if you are a CFO, transfer pricing manager, or junior pricing manager. We would like to share our...

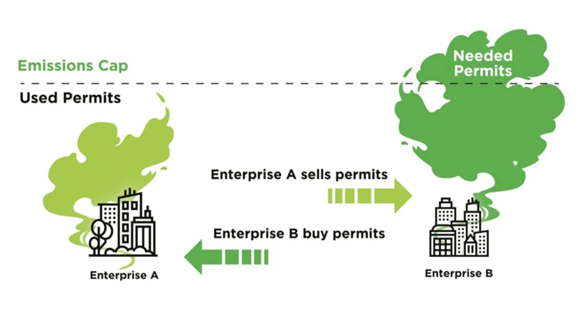

The link between transfer pricing and carbon trading

Environmental taxation and the treatment of carbon as part of an MNE’s value chain could be one of the most important trends alongside digitalization. Supporting this argument, the OECD has committed large amounts of resources in examining environmental taxes. The...