Environmental taxation and the treatment of carbon as part of an MNE’s value chain could be one of the most important trends alongside digitalization. Supporting this argument, the OECD has committed large amounts of resources in examining environmental taxes. The link between transfer pricing and carbon trading arises from the potential for companies to utilize their carbon emissions and carbon credit transactions in cost effective manners. This can be done through the strategic use of transfer pricing.

Carbon trading in a nutshell

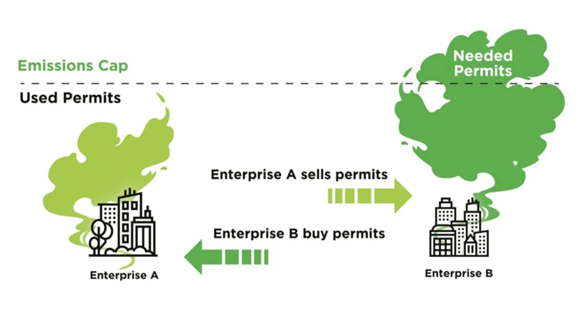

Carbon trading is a market-based mechanism aimed at reducing greenhouse gas emissions. It involves the buying and selling of carbon credits, which represent the right to emit a certain amount of carbon dioxide or other greenhouse gases. The purpose of carbon trading is to create economic incentives for companies to reduce their emissions and promote the transition to a low-carbon economy. Under a carbon tax system, companies, industries, or individuals are required to pay a fee or tax based on the amount of carbon dioxide or greenhouse gases they emit. The tax is typically levied on fossil fuels such as coal, oil, and natural gas, which are major sources of carbon emissions. Governments often use the revenue generated from carbon taxes to fund climate change mitigation and adaptation measures, renewable energy projects, research and development in clean technologies, or to offset other taxes. Carbon taxation is a market-based approach to tackling climate change. By assigning a price to carbon emissions, it allows the market to determine the most cost-effective ways to reduce emissions.

The following is two key terms in the carbon pricing sphere:

The Effective Carbon Rate (ECR) – This is the effective price signal applicable to carbon emissions, resulting from carbon taxes, fuel excise taxes, and the prices of tradable emissions permits. Around 60% of CO2-emissions from all energy use in 44 OECD and G20 countries are not subject to an ECR at all, and only around 10% to a rate of at least EUR 60 per tonne. Hence, approximately 90% of emissions are priced below a mid-range estimate of the costs of CO2-emissions to society in 2020 and a low-end estimate in 2030, being EUR 60 per tonne.

The Carbon Pricing Score (CPS) – This indicates how close OECD and G20 countries are, together as well as individually, to pricing all energy related carbon emissions at benchmark values for carbon costs. It describes the state of carbon pricing and can be compared across countries and time. At EUR 60 per tonne the CPS is 19% for the 44 countries in 2018.

Countries’ carbon pricing scores ranged from 1% to 69% in 2018. Countries with a high score tend to emit fewer emissions than countries that hardly price any emissions. High-score countries also emit less CO2 per unit of GDP and are better prepared for the low carbon economy.

It’s important to note that the specific design and implementation of carbon taxation can vary between countries and jurisdictions. Different countries may have different tax rates, thresholds, exemptions, and uses for the revenue generated. Some countries may also adopt alternative carbon pricing mechanisms, such as cap-and-trade systems, which set limits on emissions and allow for the trading of emissions permits.

What is the potential impact?

Multinational companies operating in multiple countries will need to navigate various carbon tax regimes and comply with the respective regulations. This can lead to administrative burdens, additional reporting requirements, and the need for specialized expertise in carbon accounting and reporting. Ensuring compliance across different jurisdictions can be complex and may require dedicated resources.

Here’s how transfer pricing can impact carbon trading:

Emission Allocation: Under carbon trading schemes, companies are allocated a certain number of carbon credits based on their emissions levels. By utilising the transfer pricing of their emissions-intensive activities, companies can potentially shift emissions between different entities within their corporate structure.

Cost Allocation: Transfer pricing can also be used to allocate costs related to emission reduction activities. Companies may strategically allocate costs to entities in jurisdictions with higher carbon credit prices or to entities that have a higher demand for carbon credits.

Offsetting Emissions: Some companies engage in carbon offset projects to compensate for their emissions by investing in projects that reduce emissions elsewhere. Transfer pricing can be used to allocate the costs and benefits of these offset projects within the MNE’s.

Do your MNE have a carbon team/person?

Carbon taxation can reshape the competitive landscape for multinational companies. Those with lower emissions or a lower carbon intensity in their operations may have a comparative advantage over their competitors subject to higher carbon taxes. This can incentivize companies to invest in cleaner technologies, improve energy efficiency, and reduce emissions to maintain their competitiveness.

It’s worth noting that tax authorities and regulatory bodies are aware of the potential for transfer pricing abuse in relation to carbon trading. They have been working to establish guidelines and regulations to prevent such abuse and ensure the integrity of carbon trading markets. Increased scrutiny and reporting requirements have been implemented to address transfer pricing practices that could potentially undermine the effectiveness of carbon trading schemes.

Sources:

- IMF, 2022. Carbon Taxes or Emissions Trading Systems?

- https://www.imf.org/-/media/Files/Publications/Staff-Climate-Notes/2022/English/CLNEA2022006.ashx

- https://tax.kpmg.us/articles/2023/carbon-trading-transfer-pricing-next-frontier.html

- https://iasbaba.com/2022/12/carbon-trading/

Recent Comments