Transfer Pricing Blog

Mastering the Challenges of Cross-Border Intercompany Financing

In today’s interconnected global economy, cross-border intercompany financing has become a cornerstone of multinational enterprises (MNEs) seeking to optimize their financial structures. However, managing these transactions effectively requires navigating a maze of...

Global Transfer Pricing Disputes: How Transfer Pricing Documentation Software Can Mitigate Risks

As the global trade keeps evolving, tax authorities around the world have become more vigilant in scrutinizing transfer pricing practices. The potential for profit shifting, where MNEs may move profits to lower-tax jurisdictions to reduce their overall tax liability,...

Increased Scrutiny on Intangibles in Global Transfer Pricing: The Role of Transfer Pricing Documentation Software

In today’s global economy, intangible assets—such as intellectual property (IP), brand value, and proprietary technologies—have become pivotal drivers of value and competitive advantage for multinational enterprises (MNEs). However, as these assets gain importance and...

Digital Economy and Transfer Pricing: Navigating Complexities with Transfer Pricing Documentation Software

The digital economy has fundamentally transformed global business landscapes, enabling companies to operate seamlessly across borders and leverage digital assets to drive growth and innovation. This rapid digitalization, while offering significant opportunities, also...

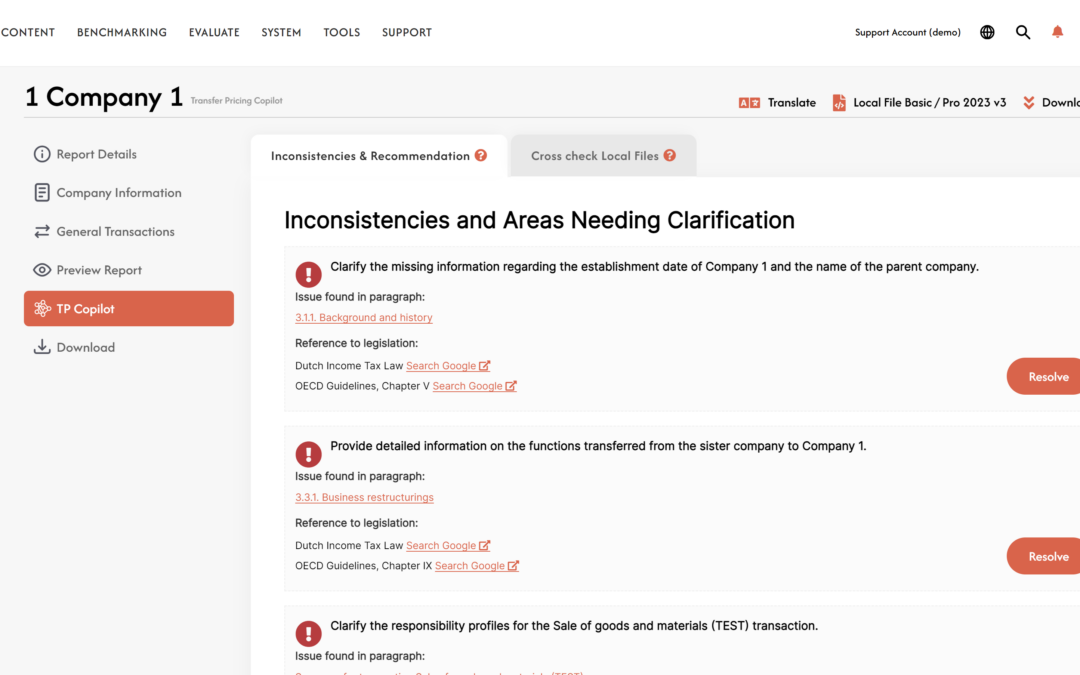

Introducing Transfer Pricing Copilot for TPGenie

We are proud to announce the release of TP Copilot, an AI-powered module now integrated into TPGenie, designed to check all documents generated by TPGenie thoroughly against the latest OECD Transfer Pricing Guidelines and local legislation. TP Copilot significantly...

Supply Chain Disruptions and Inflation in Transfer Pricing

Global supply chain disruptions, inflationary pressures, geopolitical tensions, and global elections have emerged as significant challenges in the recent world economy. Supply chain disruptions caused by restricted trade routes, energy shortages, and sanctions, have...

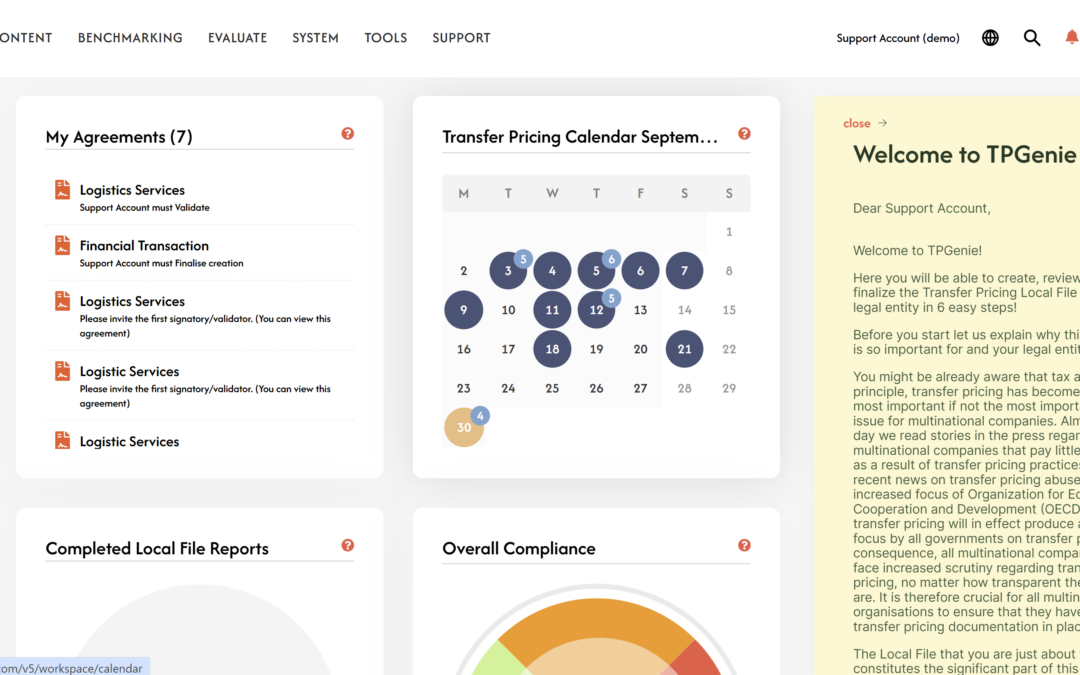

A Fresh New Look for TPGenie and Intra Pricing Solutions

Last month marked an exciting chapter for Intra Pricing Solutions and TPGenie, our flagship Transfer Pricing Documentation solution. After months of hard work by our whole team, we proudly unveiled a complete visual overhaul, introducing a fresh and modern design that...

Sustainability, ESG, and Transfer Pricing

As environmental, social, and governance (ESG) factors continue to gain prominence in the global business landscape, multinational enterprises (MNEs) are increasingly integrating sustainability into their core strategies. Transfer pricing plays a crucial role in...

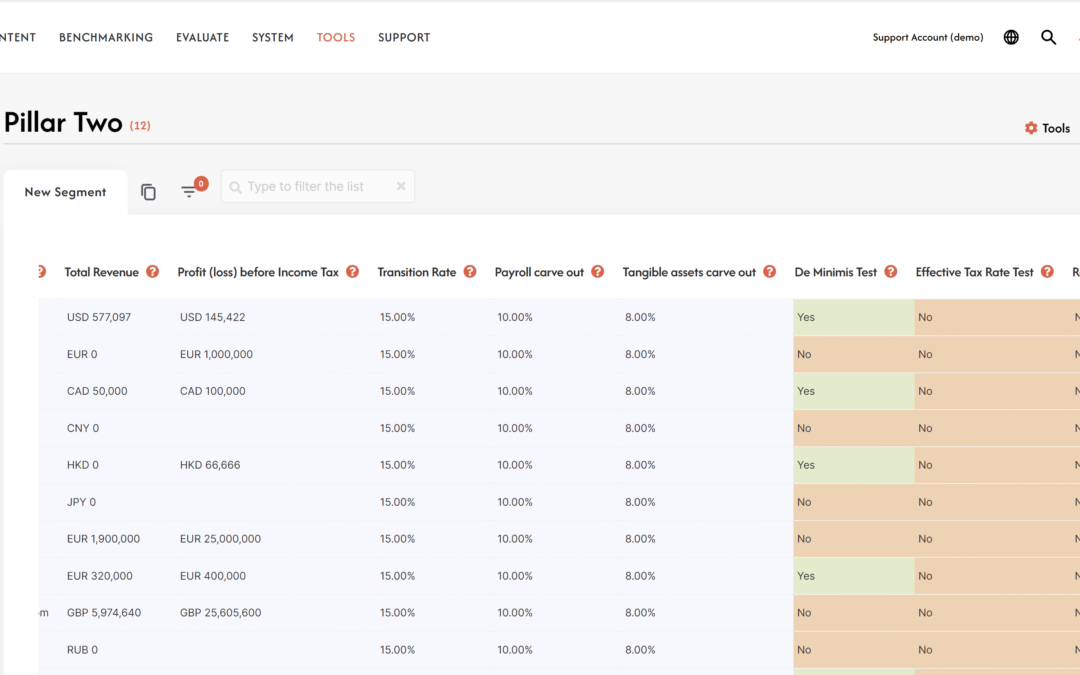

Understanding Pillar Two Software: A Key Tool for Global Tax Compliance

The Pillar Two regulations, part of the OECD’s Global Anti-Base Erosion (GloBE) framework, require multinational enterprises to calculate and report global tax liabilities. With this, the need for Pillar Two software has emerged, designed to streamline the process of...

Unlocking Transfer Pricing Compliance: The power of the TPGenie compliance tracker tool

Compliance with transfer pricing regulations across multiple countries presents a complex challenge for organizations operating and planning to expand internationally. This requires careful navigation in understanding diverse regulatory landscapes and meeting all the...