Inflation has been on an upward curve over the last few years and most central banks have followed with changing the monetary policy. The recent surges in interest rates and the volatility in the financial markets have changed the risk equation. This volatility causes transfer pricing risks to be under great attention as further changes may be expected in 2023. The higher interest rates however could also favour group arrangements from third party lenders, but this could lead to more complex arms-length considerations.

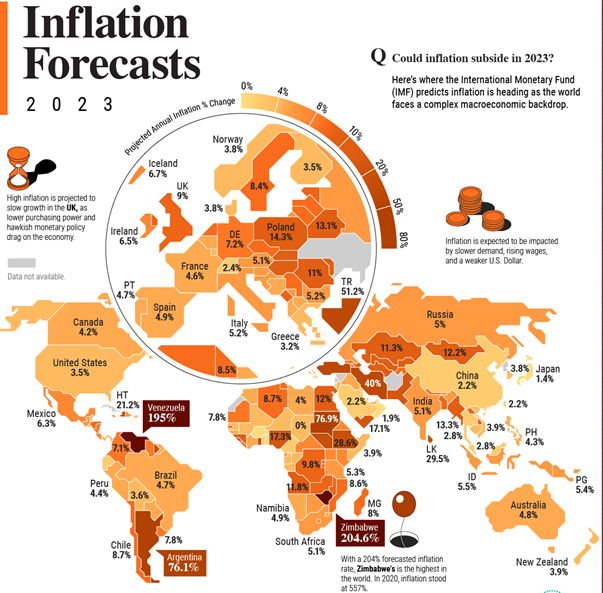

By looking at the IMF forecast, there will be inflation changes around the world in 2023 that will continue to impact monetary policies. These changes have an impact on transfer pricing on various levels. One specific aspect is the effect it has on real estate portfolios in terms of loan agreements and transactions.

Impact of high interest rates

The oversimplified cause of high interest rates is the increased demand for money or credit. This changes the interest rates of transactions on real estate causing transfer pricing managers lots of extra work. It’s worth noting that the specific impact of high interest rates on transfer pricing in real estate can vary depending on factors such as the specific transaction, the jurisdictions involved, and the overall economic conditions.

The higher interest rate benchmark would imply that funding cost has risen. The adjustment in the cost of financing must ideally filter through to inter group funding arrangements. It is essential that the new market interest rates must be reflected in the upcoming transactions. When adjusting the interest rate concluded between the parties related, it is important to pay attention to check if all the loan agreements are market based and to check if the interest rate of transactions does not exceed the maximum allowable interest rate.

Let’s consider a few potential effects of the higher interest rates:

Financing Costs: High interest rates increase the cost of borrowing funds for real estate transactions. When related entities within a multinational company engage in intercompany lending or provide financing to each other for real estate projects, the interest rate charged on these loans may be influenced by prevailing market rates. If interest rates are high, the borrowing entity may face increased costs, impacting the profitability of the project and potentially affecting the transfer pricing arrangements.

Determination of Arm’s Length Pricing: Transfer pricing rules require that intercompany transactions be conducted at arm’s length, meaning the prices should be comparable to those in a similar transaction between unrelated parties. When determining the transfer price for real estate-related transactions, such as rental income or the transfer of property, the interest rate applied to financing arrangements can be a significant factor. High interest rates in the market may influence the arm’s length interest rate that should be charged on intercompany loans, affecting the overall transfer pricing arrangement.

Profit Allocation and Tax Planning: Transfer pricing plays a role in determining the allocation of profits and costs among related entities. High interest rates may impact the profitability of real estate projects and, consequently, the allocation of profits. Companies engaged in transfer pricing planning may consider the impact of high interest rates on the profitability of related entities involved in real estate transactions and adjust their transfer pricing strategies accordingly to optimize tax outcomes.

Documentation and Compliance: Transfer pricing documentation requirements typically involve demonstrating that the prices applied in related-party transactions are consistent with arm’s length principles. When high interest rates are prevalent, it becomes important for companies to document and support their transfer pricing arrangements, including the interest rates applied to financing transactions. Adequate documentation is crucial to demonstrate compliance with transfer pricing regulations and defend the pricing decisions made in real estate-related transactions.

The increase in the interest rate also impacts the financing transactions between business subsidiaries. Related parties have to ensure that the agreements and arrangements continue to be in line with the market conditions. In volatile market conditions transfer pricing software solutions could be of great value.

TPGenie can help

Intra Pricing Solutions offer their TPGenie product as a solution for transfer pricing managers and companies needing to adapt to the higher interest rates. TPGenie helps you to efficiently create, update and manage your transfer pricing documentation, including Master file, Local files, Intercompany Agreements, Benchmarks and Country-by-Country Reporting.

The tool can be of assistance on many levels regarding interest rate changes including:

- Benchmarking and analysis: TPGenie offer analytical capabilities to analyse financial data and benchmark transactions against comparable data from external sources. TPGenie’s Benchmarking Database takes the complicated process of performing an economic analysis off your hands through providing high quality benchmarking studies in few easy steps. It simplifies transfer pricing analyses, including profit and transaction-based analyses. This assists in determining arm’s length prices for intercompany transactions.

- Risk Assessment: TPGenie can help companies identify potential transfer pricing risks, such as misalignment between transfer prices and economic substance. It can provide risk assessment models and scenario planning to support decision-making related to transfer pricing strategies. The tool also offers a currency conversion module. This module provides an ability to change financials uploaded in a local amount to transaction amount and vice versa as well as visualise the amounts in a currency of choice for a better comparison of the data.

- Documentation and Compliance: TPGenie helps companies generate and maintain documentation required to demonstrate compliance with transfer pricing regulations. This includes preparing transfer pricing reports, master files, local files, and country-by-country reporting. TPGenie’s Intercompany Agreement Creation Module provides you with the ability to easily create agreements in a clear and efficient manner as well as boost efficiency by automating signatures and approvals.

With the interest rates most likely to change again in the coming months, TPGenie can guide your transfer pricing needs and help to manage your real estate portfolio better. The tool can help you to automate data collection, analysis, and reporting processes, saving time and improving accuracy freeing up time for more essential work-related matters.

Image source: IMF/Visual Capitalist

Recent Comments