Transfer pricing (TP) encompasses the rules and conditions that dictate transactions within a Multinational Enterprise (MNEs). Primarily it concerns the inter-company prices charged between associated enterprises in different jurisdictions. Therefore, transfer prices are the prices at which an enterprise transfers physical and intangible goods or services to an associated enterprise.

The concept of associated enterprise is of focal importance in these practices. It covers direct or indirect participation in the management, control or capital of one enterprise in another enterprise in a different state or when the same person participates directly or indirectly in an enterprise’s management, control or capital.

Thus, TP can be deemed a crucial element of tax planning for MNEs since it directly affects the allocation of income and expenses among the different entities within a group, and the basis for taxation between two states.

When it comes down to tax law, TP is based on the Arm’s Length Principle (ALP), which the Organization for Economic Cooperation and Development (OECD), has adopted in Article 9 of the OECD MTC.

What is the Arm’s Length Principle?

As stated by the OECD and the United Nations (UN), the principle of Arm’s Length Principle (ALP) for TP has been the international standard for allocating taxable income among members of MNEs, and their Permanent Establishment (PE). In essence, the ALP treats members of an MNEs group as separate entities. This approach requires associated enterprises to conduct intra-group transactions, for tax law purposes, as if they were independent entities, thereby ensuring that they do not deviate from what the open market demands. In other words, taxation is based upon a fictional normal transaction.

To provide guidance on the application of the ALP, the OECD TP guidelines for MNEs and tax administrations laid down some parameters. In order to determine the comparability of the controlled transaction and those carried out by independent parties, some commercial and financial relations need to be assessed: the contractual terms of the transaction, the functions performed by each of the parties, the characteristics of the property transferred, the economic circumstances of the parties and the market, and the business strategies pursued.

From a tax policy perspective, the adoption of the ALP fosters fairness and impartiality between associated and non-associated enterprises by providing a level playing field for tax considerations. Thereby respecting the principles of neutrality and equality. In addition, it promotes the expansion of international trade and investment.

More info on the Arm’s Length Principle can be found in this article.

Example

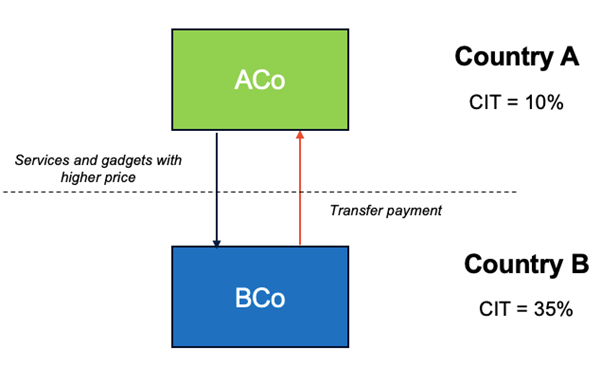

Consider ACo, a multinational enterprise (MNE) with its headquarters in Country A, where the corporate income tax rate is relatively low at 10%. This rate is significantly lower compared to neighbouring countries. ACo has a subsidiary called BCo in Country B, where the corporate income tax is much higher at 35%.

ACo manufactures innovative gadgets in Country A and provides software and support services through its subsidiary, BCo, in Country B. To reduce its overall tax liability, ACo engages in an intra-group transaction with BCo, charging a higher price for the gadgets sold to BCo. This strategy inflates the costs for the subsidiary (BCo), resulting in BCo reporting higher costs and lower profits in Country B, thus decreasing its tax liability in the high-tax jurisdiction. Simultaneously, the high prices paid to ACo increase its revenue and profits in Country A, which has a lower tax rate.

This arrangement leads to overall tax savings for the MNE. However, tax authorities in both countries are likely to scrutinize this transaction to ensure it complies with the ALP.

Numerical example:

Consider the exact facts of the previous example.

ACo (Country A)

- Manufactures gadgets

- Unitary Cost of production = 100 €

- CIT = 10%

ACo sells gadgets to its subsidiary BCo (Country B)

- CIT in Country B = 35%

- Unitary intra-group transfer price = 200 €

Results of the intra-group transaction

- ACo’s profit = 100 € per gadget (200 € revenue – 100 € in production costs)

- BCo’s profit = It is reduced due to the high costs imposed by ACo.

Tax implications

- ACo, in Country A, will pay taxes based on its profits at a tax rate of 10%, which is lower than it would have been if the transfer price was set at a market value.

- BCo, in Country B, will pay taxes based on its profits at a tax rate of 35%, which has been reduced after the intra-group transaction.

Benefits and Drawbacks of Transfer Pricing in Taxation

Benefits

- Reduce tax liability. By strategically setting TP, MNEs are able to reduce their tax base in jurisdictions where the tax rate is comparatively higher than in others.

- Allocation of costs. TP allows MNEs to allocate costs and resources amongst the different entities within the group in an efficient manner. By doing so, MNEs can streamline operations, distribute risks, and improve profitability.

Drawbacks

- Compliance costs. Ensuring that MNEs are complying with TP regulations can be time-consuming and expensive. In addition, a proper accounting system must be in place in order to justify the intra-group transactions.

- Valuation of intangibles. Difficulty in establishing a transfer price that is in accordance with the ALP for hard-to-value intangibles (HTVI).

Sources:

- OECD (2022), OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2022, OECD Publishing, Paris, https://doi.org/10.1787/0e655865-en.

- Transfer pricing in the EU context. (n.d.). Taxation and Customs Union. https://taxation-customs.ec.europa.eu/transfer-pricing-eu-context_en

- Dwarkasing, R. S. (2013). The Concept of Associated Enterprises. Intertax, 41(Issue 8/9), 412–429. https://doi.org/10.54648/taxi2013038

- RAMON DWARKASING, R. D. (2013, September 27). COMMENTS ON THE REVISED DISCUSSION DRAFT ON TRANSFER PRICING ASPECTS OF INTANGIBLES. Maastricht University. Retrieved August 24, 2022, from https://www.oecd.org/ctp/transfer-pricing/dwarkasing-maastricht-university.pdf

- Wittendorff, J. (2010). Transfer Pricing and the Arm’s Length Principle in International Tax Law. Kluwer Law International B.V.

Recent Comments