In the past three decades, multinational companies have experienced no business function that grinds so deeply into all international operations as transfer pricing. Strategic decisions on transfer pricing have a large-scale impact on foreign operations of MNC’s, because it directly affects profits and global revenues. Growing international trade in intangible assets and e-commerce have made the documentation strategy essential, but tricky.

Developing an effective transfer pricing documentation strategy is crucial for multinational companies to comply with tax regulations and minimise transfer pricing risks. The documentation strategy must have a clear explanation of the selected transfer pricing method, the data used and the application of the method to determine the arm’s length prices. The detailed financial and non-financial information must also be included to demonstrate the accuracy of the pricing.

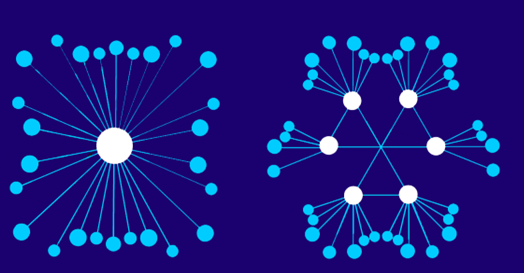

There are two distinct ways in getting there and a combination of both approaches that might be the best solution. In the context of transfer pricing documentation, a centralised approach and a local approach refer to two different options to prepare and manage transfer pricing documentation within a multinational enterprise. Each of them come with their own benefits and drawbacks:

Centralised Approach

In a centralised approach, the responsibility for preparing and managing transfer pricing documentation rests primarily with the central or head office of the MNE. Information always flows through a central point. The dedicated central point contains all the required logic to execute a carry out the main documentation process. The central office takes the lead in formulating transfer pricing policies, conducting benchmarking analyses, and preparing the necessary documentation to support intercompany transactions across different jurisdictions.

Main advantages of a centralised approach:

- Consistency: It allows for consistent transfer pricing policies and documentation across the MNE group, ensuring a coherent and unified approach.

- Efficiency: By centralizing the process, the MNE can achieve economies of scale in data collection, analysis, and documentation preparation.

- Control: The central office has greater control over the transfer pricing process, ensuring compliance with applicable regulations and minimizing the risk of inconsistent documentation. Technology can be vetted, tested and approved that will serve all.

- Vision: Centralised leadership can develop a vision that can be executed across the enterprise.

Main challenges of the centralised approach:

- Local needs: Unique needs of certain business units and geographic locations can be overlooked.

- Buy in: As not all local entities are involved in decision making it can take time for them to buy in a centralised plan and system.

Local Approach

In a local approach, each local entity or subsidiary within the MNE is responsible for preparing and maintaining its own transfer pricing documentation. Under this approach, the local entities are typically required to comply with local country regulations and guidelines regarding transfer pricing documentation.

Main advantages of a local approach:

- Local Compliance: It allows each entity to tailor the transfer pricing documentation to the specific requirements and regulations of the local jurisdiction, ensuring compliance with local rules.

- Responsiveness: Local entities have a better understanding of their specific business operations and market conditions, enabling them to provide more accurate and relevant documentation.

- Risk Management: In cases where transfer pricing audits or disputes arise, having comprehensive local documentation can help defend the arm’s length nature of intercompany transactions at the local level.

Main challenges with the local approach:

- Economies of scale: Many duplications across systems can increase unnecessary cost.

- Redundancy: The duplication of systems can lead to technical and support issues.

A transfer pricing dilemma

Multinational companies often sit with the challenge that some units use GAAP (Generally Accepted Accounting Principles) and other use IFRS (International Financial Reporting Standards).

The more localised focus of GAAP is mostly used in the USA and have a strong rule-based approach. The GAAP have a strong focus on guidelines and specific rules for various accounting treatments. This differs from the principle focused IFRS that focus on global accounting harmonization. The broad objectives and principles open the door for professional judgement and flexibility in applying the standards. The IFRS is used by 125 countries around the world. There has been a shift towards the global adoption of IFRS driven by the need for consistency and comparability in financial reporting across the world.

It is essential to keep in mind that some jurisdictions still use their own GAAP and this forces companies in that direction. This could imply that companies use GAAP locally and IFRS globally to meet the needs for different stakeholders.

A possible solution

As companies operate in different areas with different regulations, many organisations are using technological solutions for guidance. With the use of technology, companies can be up to date with the latest regulations that helps them to comply in all the countries they operate in.

TPGenie by Intra Pricing Solution is a software solution that could help companies strike the balance between the centralised and local approaches. The hybrid approach offered by the tool helps to balance the global consistency in the centralised approach, while also guiding companies in local compliance. Balancing centralised control while also adhering to the requirements of each jurisdiction where they operate in. TPGenie can assist companies in this hybrid model through:

- Loading figures centrally from global ERP systems, while also helping companies to check them for each local jurisdiction.

- Offering a master file that can help companies to get a 360-degree look at their global transfer pricing operations and policy.

- Giving detailed local files of the intercompany transactions in each country they operate in with its jurisdiction’s tax authority.

- Showing a country-by-country report that gives a snapshot summary of the activities of the company’s entities that operate within a given jurisdiction.

Documents that used to be drawn up by external companies and partners can be done through the TPGenie software. TPGenie is the ideal solution for your companies transfer pricing strategy.

Sources:

Abdallah, W. (2017). The Conversion From US-GAAP to IFRS and Transfer Pricing: Irreconcilable Differences. The Journal of Applied Business Research.

Recent Comments