Transfer Pricing Blog

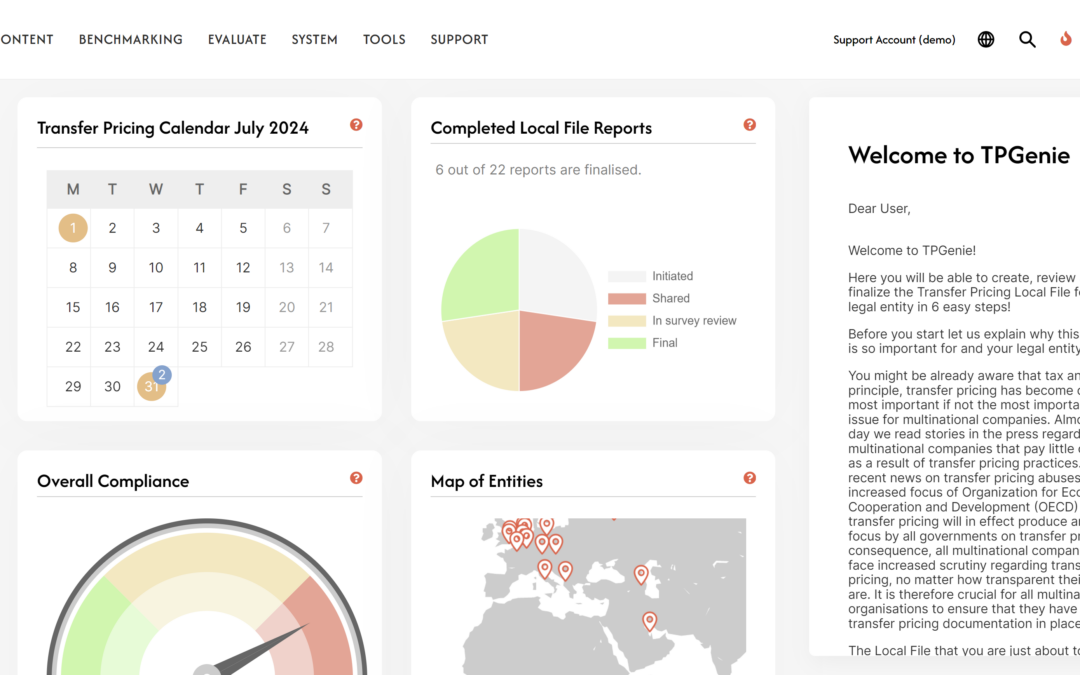

Transfer Pricing Documentation with TPGenie: The Leading Transfer Pricing SaaS Solution

Transfer pricing is one of the most critical tax issues faced by multinational enterprises (MNEs) today. As regulatory scrutiny intensifies worldwide, ensuring that your transfer pricing documentation is both accurate and compliant has never been more important. For...

Upcoming Design Update for TPGenie

In the coming month, TPGenie will undergo a significant visual update. After months of dedicated work, the team is ready to unveil a fresh design and new branding for TPGenie. This update aims to enhance user experience with a clearer, more modern interface. What’s...

TPGenie’s Next-Gen Interface

TPGenie, your trusted companion in writing and automating transfer pricing documentation, is ready for a transformative leap. After more than half a decade of steadfast service, our platform is evolving to meet the zeitgeist of the modern digital era. We're thrilled...

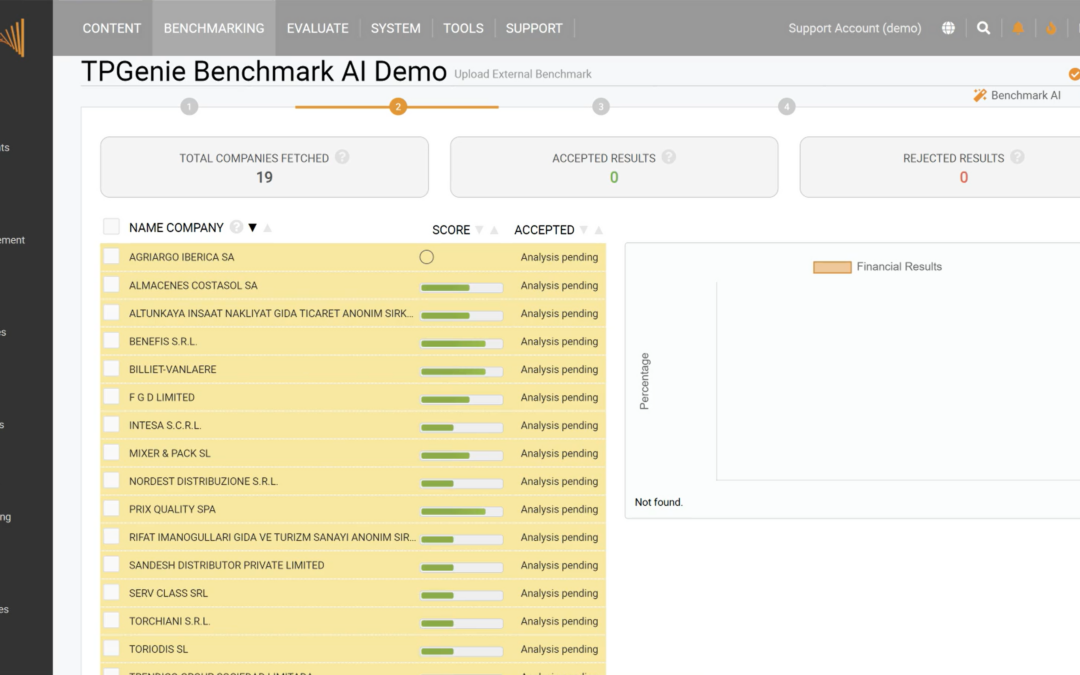

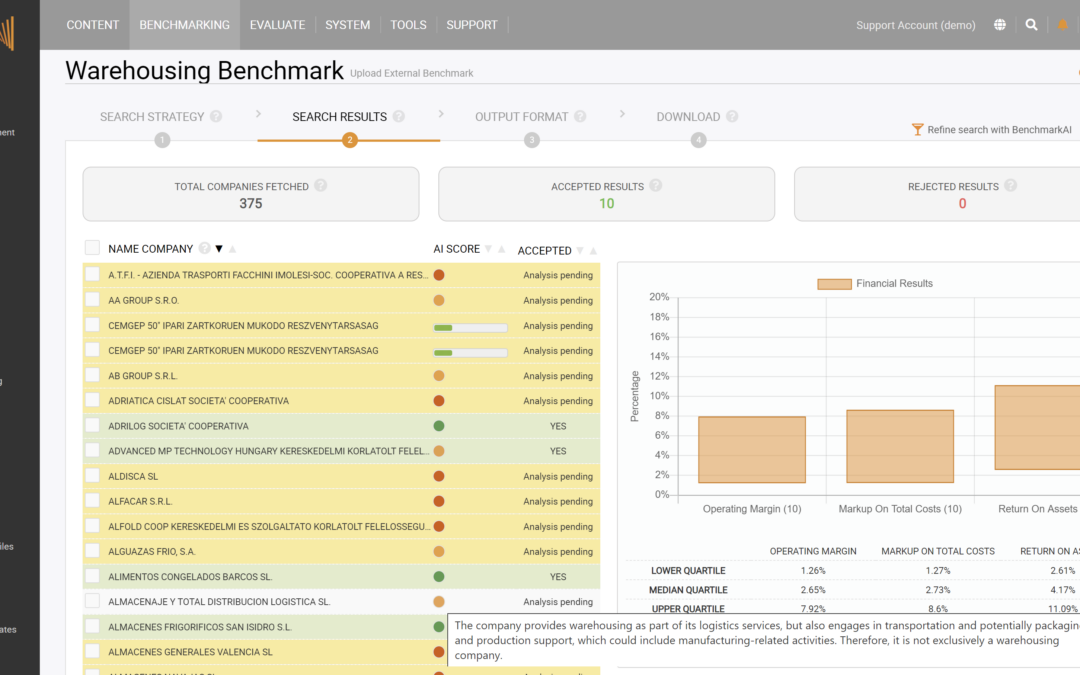

VIDEO: Revolutionise your transfer pricing benchmarking with TPGenie Benchmarking AI!

Say farewell to the time-consuming manual process and embrace a new era of precision and efficiency. Our AI-driven solution not only automates your benchmarking studies but provides an impressive 95% accuracy rate in filtering search results. Compatible with leading...

TPGenie Benchmarking AI for Transfer Pricing: Frequently Asked Questions

Welcome to the FAQ section for TPGenie Benchmarking AI, your comprehensive solution for transfer pricing studies. Below, you'll find detailed insights into how TPGenie integrates with databases and Excel files, its capabilities in financial analysis, market range...

Results of automating Transfer Pricing Benchmarking using Artificial Intelligence (AI): 95% accuracy!

Enter TPGenie Benchmarking AI, a solution that is revolutionizing how transfer pricing experts approach their benchmarking studies, enhancing accuracy, efficiency, and turnaround time for completing your transfer pricing benchmarking studies. 95% Accuracy in AI...

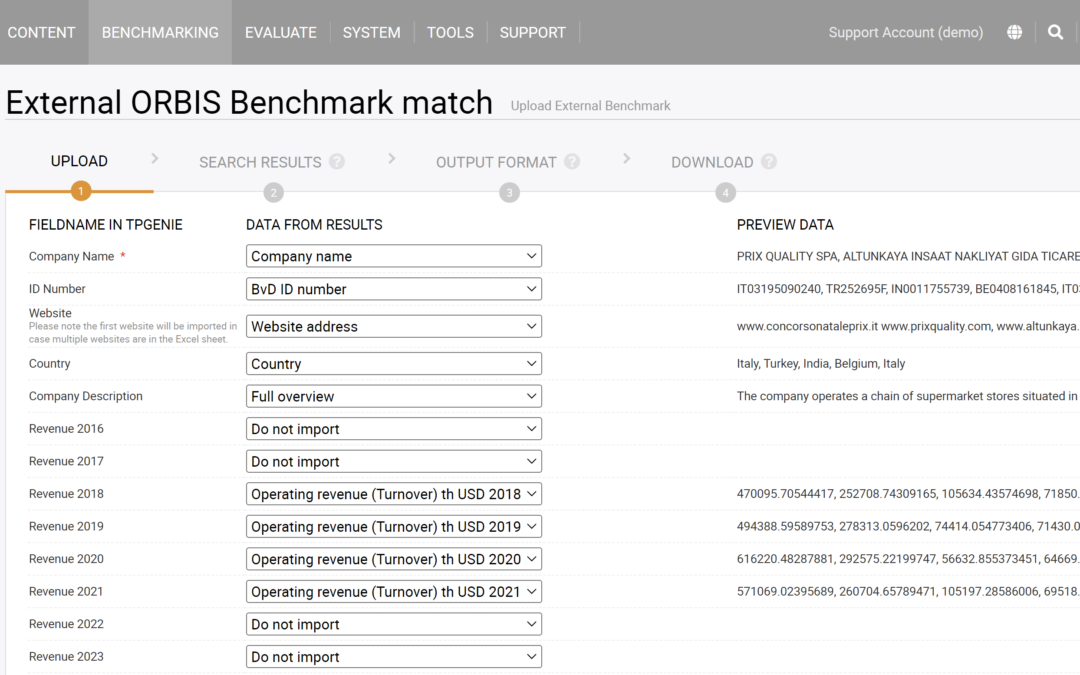

New feature: Upload External Benchmark

TPGenie introduces the Upload External Benchmark feature, streamlining the process of importing and analysing transfer pricing benchmark data. This new tool facilitates a more efficient workflow by allowing users to easily upload their data extracts and select the...

Streamlining Transfer Pricing Documentation with TPGenie: A Future-Proof Solution for Tax Managers and Experts

In the realm of transfer pricing, the challenges of standardisation and automation are paramount. With the introduction of TPGenie, a cutting-edge software designed to automate and standardise transfer pricing documentation, these challenges are not only met but...

Boost Your Transfer Pricing Benchmarking: TPGenie’s BenchmarkAI-Powered Solution Saves Time and Delivers Precise Results

Supercharge your transfer pricing benchmarking with TPGenie's latest features: BenchmarkAI, our cutting-edge AI technology driven by OpenAI's ChatGPT revolutionizes the benchmarking process, saving you valuable time and ensuring precise results. Whether you prefer...

A solution for the new transfer pricing regulations in Moldova

In December 2022, The Republic of Moldova officially implemented its inaugural transfer pricing regulations, marking a significant development for businesses operating within the country. These regulations have been crafted in accordance with the guidelines set forth...