Transfer Pricing Blog

Things to consider when purchasing transfer pricing software

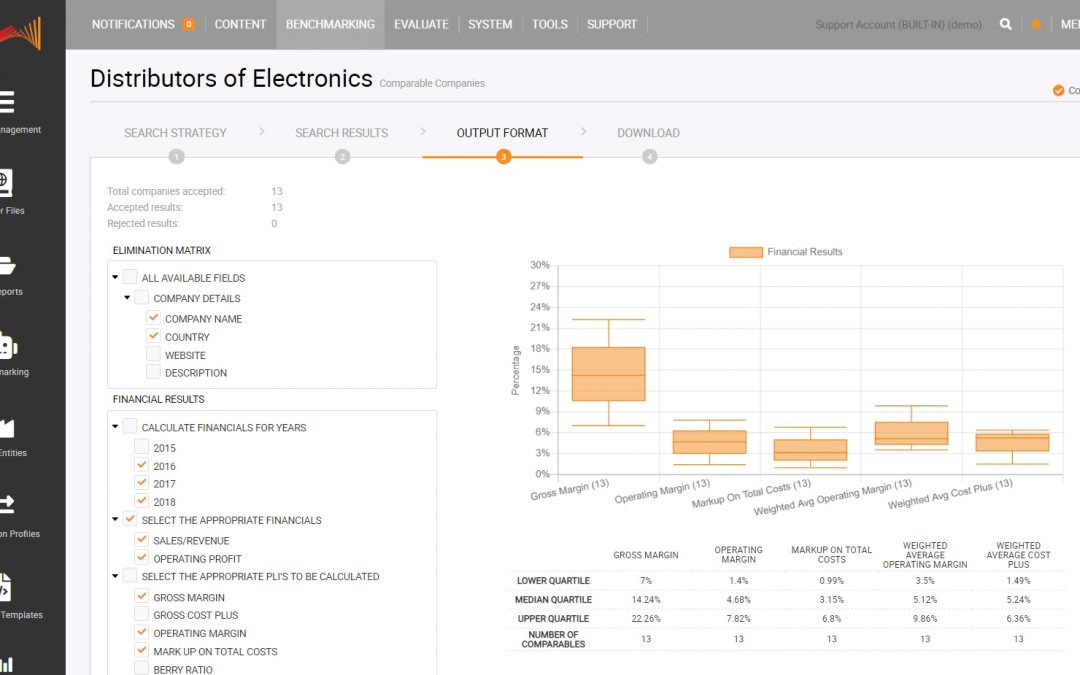

When purchasing a transfer pricing documentation tool, there are several important success factors to consider. Reliability and accuracy The tool should provide accurate and reliable results. The calculations should be based on the latest transfer pricing rules and...

What is transfer pricing?

Transfer pricing (TP) encompasses the rules and conditions that dictate transactions within a Multinational Enterprise (MNEs). Primarily it concerns the inter-company prices charged between associated enterprises in different jurisdictions. Therefore, transfer prices...

ChatGPT and Transfer Pricing benchmarking

Transfer Pricing benchmarking studies require a considerable amount of data and information about the companies being compared. The more accurate and reliable the data, the better the benchmarking study's results. This is where ChatGPT from OpenAI comes in. ChatGPT...

ChatGPT in transfer pricing software TPGenie

TPGenie has made a significant leap towards automation and artificial intelligence by seamlessly incorporating ChatGPT - a state-of-the-art natural language generation system. Utilizing OpenAI's AI-powered technology, TPGenie can now produce natural language responses...

How to stay updated with Transfer Pricing Regulations?

The Organisation for Economic Co-operation and Development (OECD) project on base erosion and profit sharing has caused an increased interest in transfer pricing regulations. The recommendations and guidance the OECD gives is interpreted by each nation, and this leads...

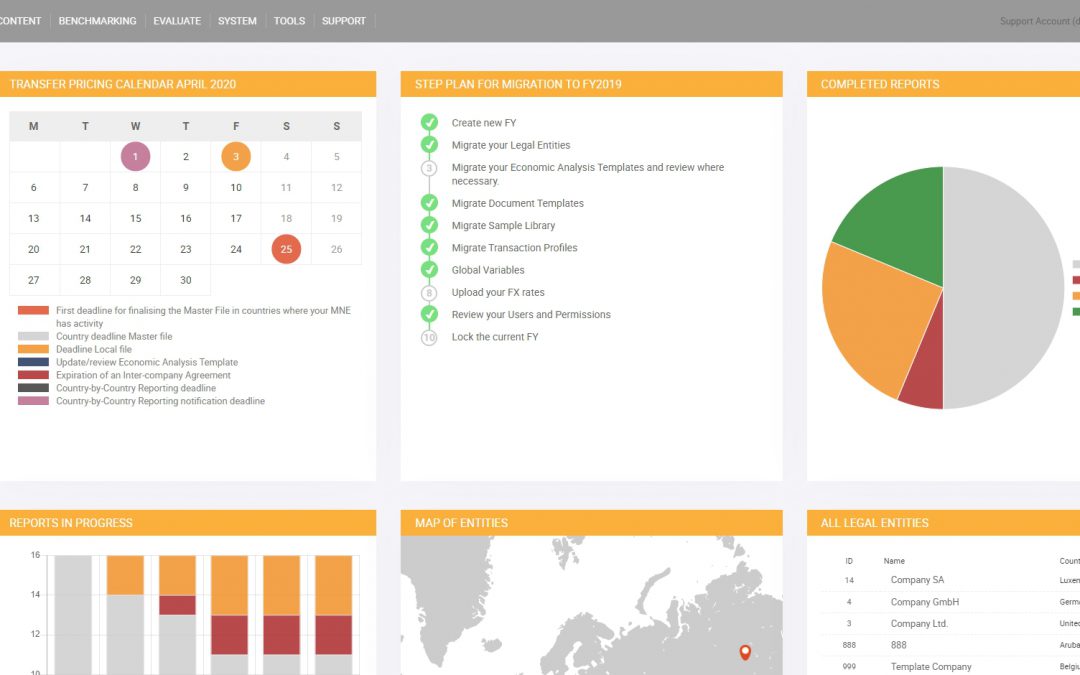

How to automate transfer pricing documentation processes?

Automation of your Transfer Pricing documentation process can be challenging exercise. The importance of data and the help it gives to ground facts, plans and strategies are undoubtably true in transfer pricing. Organising this data could be a headache as accounting...

Pixel Perfect Document Formatting with TPGenie

TPGenie has a powerful tool that offers document formatting features to enhance the overall look and feel of outputted documents. With TPGenie, you can customize the margins, fonts, colors, tables, headers, and footers of your documents to match your company's...

Summary of the OECD Transfer Pricing guidelines

The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations were first implemented in 1995, with the intent to minimise conflicts between Multinational Enterprises (MNE) and Public Administrations in transactions involving Transfer...

Transfer Pricing Software vs. Consultants

Transfer pricing software vs consultants are the two sought-after methods for managing the complexities of a multinational enterprise’s transfer pricing policy. The use of Transfer pricing software vs consultants comes with its own advantages and disadvantages. It is...

What is interest rate benchmarking transfer pricing?

A challenging year We are fast approaching the end of a challenging 2022. We can approach 2023 with energy and zeal, but history have teached us that challenges are inevitable. The American financier and statesman Bernard Baruch famously said: “The art of living lies...