Don’t waste your time on sending back and forth Excels and lots of emails! TPGenie transfer pricing software is equipped with the CbCR Survey. The CbCR Survey is easy to use workflow software that enables you to gather your local CbC data across your group entities. On central level you can upload initial data such as entity details from your company book. On local level data is filled and/or confirmed.

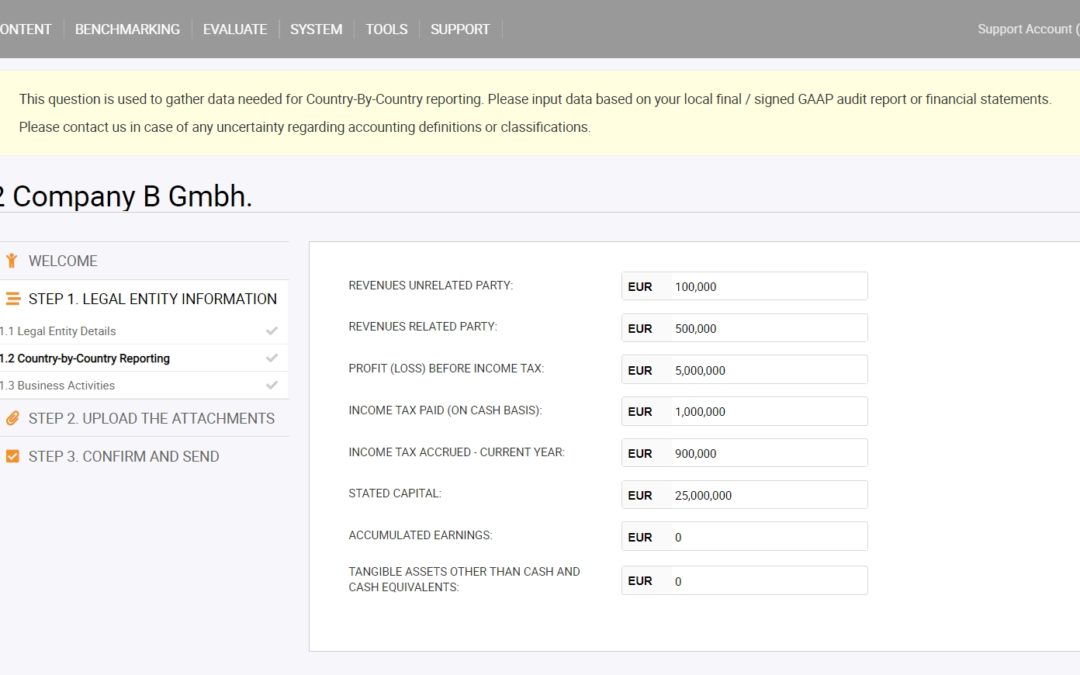

To gather data needed for Country-By-Country reporting the CbCR Survey delegates a number of questions to each of your local entities. The person locally responsible, such as financial controller, tax manager or CFO is guided through an intuitive step process to provide local CbC data.

How does the CbCR Survey work?

At every step you will be asked to provide the data or change the pre-filled data. Each step is confirmed by a save button to finalise the work, resulting in an audit trail being recorded. Steps can be rejected resulting in a conversation or the local actor can contact HQ in case of any uncertainty regarding accounting definitions or classifications. The steps are documented by help texts which informs the user about which input is required and the source of the pre-filled data.

The CbCR survey is fully customisable up to the needs and procedures of your MNE. An example of steps included in the CbCR Survey are:

Confirmation of data such as:

- Name of the entity

- Entity’s address details

- Tax IDs

- Business Activities

- FTEs

- Other info such as remarks

Provision of Entity’s financial data based on the local final / signed GAAP audit report or financial statements (Table 2):

- Revenues Unrelated Party

- Revenues Related Party

- Profit (Loss) Before Income Tax

- Income Tax Paid (On Cash Basis)

- Income Tax Accrued – Current Year

- Stated Capital

- Accumulated Earnings

- Tangible Assets Other Than Cash And Cash Equivalents

The CbC Survey workflow software can be used by:

- Multinational enterprise groups;

- Law firms;

- Tax advisors;

- Accounting companies.

Contact us for a demo or more information by clicking the button below.

Recent Comments