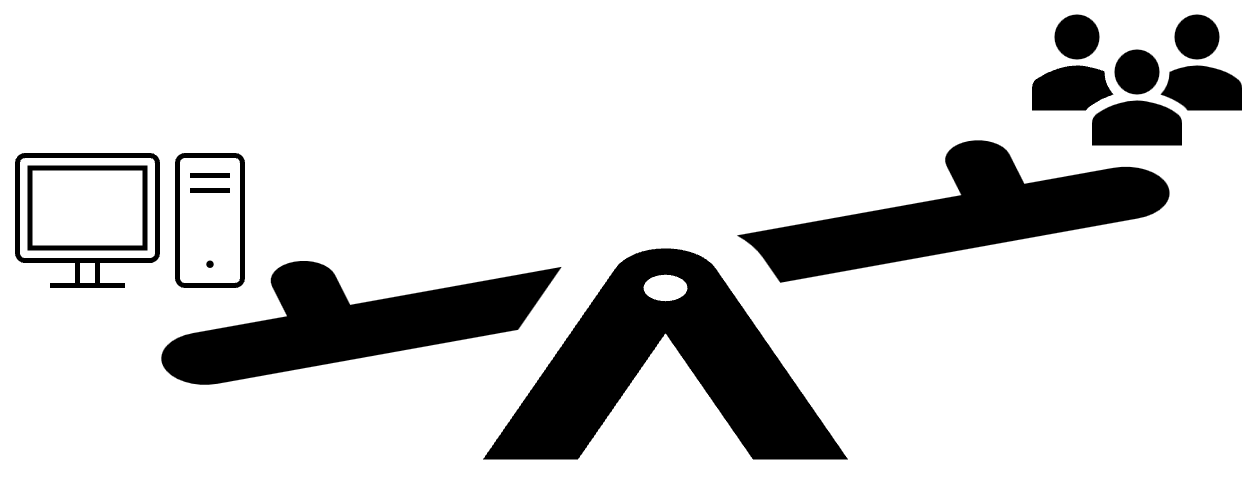

Transfer pricing software vs consultants are the two sought-after methods for managing the complexities of a multinational enterprise’s transfer pricing policy. The use of Transfer pricing software vs consultants comes with its own advantages and disadvantages. It is therefore important to figure out what works best for your business.

The pros and cons of using TP software

Most multinational enterprises (MNE’s) have structures that stretches beyond one geographical location. The operation between different locations and tax jurisdictions makes transfer pricing between units tricky to manage. The consultants and software must help companies in a variety of ways that could include advice around restructuring, plans to expand into new geographical regions, meeting compliance requirements from the authorities, needing more effective systems to manage transfer pricing etc.

The lack of data on corporate taxation have been apparent. This has caused a major limitation in measuring the economic and fiscal effect of taxes. Authorities find it difficult to measure transfer pricing assessments of transactions happening between linked companies. The current legal requirements that multinational enterprises must meet calls for careful attention regarding preparation of Master file, Local files, Country-by-Country Report and supporting documents such as transfer pricing benchmarks and inter-company agreements.

The bottom-line question companies must ask themselves in assessing their structure around transfer pricing is how they could meet the compliance requirements, while also having effective systems in place that can save time and money?

Consultant and Transfer pricing software

There are different routes to take in managing global transfer pricing. The main routes are choosing software solutions to manage a company’s system effectively, using external consultants to guide the process or having a combination of the two solutions. Using software or consultants comes with certain advantages and drawbacks. Let’s look at some of the key advantages of favouring to the software or consultant side when approaching transfer pricing:

Transfer pricing software

Main advantages:

- Software can save time and money in moving away from manually calculating transfer pricing

- Software can centralize the data making it easier for all departments and role players working with the data

- Software gives the benefit of a secure digital platform to store and retrieve data from

Main disadvantages:

- MNE’s need inhouse knowledge and manpower to manage the software

- A large initial investment is needed to train the users of the software

Below is some of the advantages in more detail:

Legal – All in one transfer pricing documentation like Intra Pricing Solutions’ TPGenie helps companies to efficiently create, update and manage transfer pricing documentation. This documentation includes the Master file, Local files, Intercompany Agreements, Benchmarking databases and Country-by-Country Reporting. Additionally, TP Genie has a Legal Entity Management module that is developed to provide scrutiny and transparency, and helps to manage complexity and risk, giving better control of data and insight into the entity compliance process.

Software tools could help to meet the BEPS Action 13 Country-by Country requirements by using data to perform risk analysis to avoid additional audits by tax authorities. The software can also assist in complying to country specific XML formats as some countries slightly deviate in formats required. The software tool could automatically adjust to the required formats from different countries. The data can also be stored in a cloud that makes it easy when audits happen as the data is available by a click of a button.

The regulations of the tax authorities often change. The Dutch government may impose a certain regulation in 2023, while the OECD only imposes that same regulation in 2024. The TPGenie software tool that Intra Pricing Solutions offer is regularly being updated to meet the challenging specifications of the authorities. This helps companies to be updated about the newest regulations, while having the luxury of software making the process smooth and effective.

Structuring – Transfer pricing software gives the advantage to have all the data centralised, and this helps with workflow and easy cooperation between colleagues. Digital tools could also assist companies operating in a multinational way in automatic currency conversions towards the reporting entities functional currency. Companies with structures that is similar year-to-year could efficiently use digital tools to process transfer pricing data routinely. This adds to efficiency within the finance and accounting department.

Digital tools could assist in risk analysis by automatically calculating imported data and visualizing the tax ratios. Key performance indicators can guide trough graphs which jurisdictions need additional attention and clarification. Digital tools also enable you to communicate with the tech experts and transfer pricing specialist behind the programs.

Reduce cost and efficient – The automation of processes in business is widely recognized as an effective measure to reduce cost. This is especially true in finance and accounting departments. Software tools could help in the transfer pricing process by sanitizing the data in order to meet the standards required by authorities. Excel files from a company could be centrally uploaded onto the software and this data can then be compiled into XML formats. The software could help reduce cost and boost efficiency for different entities including multinational enterprises, tax advisors, accounting companies and transfer pricing consultants.

Transfer pricing consultants

Main advantages:

- Consultants can provide an unbiased opinion and assessment of your companies transfer pricing policy

- Consultants can provide advice on strategies to stay compliant with regulations

- Consultants can help to understand the entire transfer pricing system

Main disadvantages:

- Using consultants could be time consuming as you must communicate directly with the consultant

- Consultants could be costly as they charge hourly or fixed rates

- Consultants can be limited in their experience and may not be familiar with specific types of transfer pricing

Below is some of the advantages in more detail:

Complex compliance – In the process of meeting the requirements of tax authorities, companies face a major burden in meeting these compliance standards. Transfer pricing policy often changes as tax authorities try to keep a firm hand on developments within the industry. Companies having lots of intangible assets like patent rights, goodwill, software and trademarks may have difficulties with utilising transfer pricing software to the full extent. Companies combining a mixture of business models and practises may also benefit from the guidance of a consultant. The strategic expertise of consultants could be a benefit for your company when these exceptional cases come to the fore. In terms of guidance, transfer pricing strategy consultants often have knowledge of how industries function and what the specific industry needs are. Especially if your team lacks knowledge, consultants could be of benefit in potential audits and managing disputes.

An example of this is when there are uncertain tax positions on the company’s financial statements. The uncertainty could be met with the knowledge of consultants with extensive experience in transfer pricing as they would understand the transfer pricing and industry risk. Their guidance could then reduce the risk of a dispute with tax authorities.

Strategy and planning – When your company wants to start implementing transfer pricing and when you do not have enough experience within your organization regarding transfer pricing, independent consultants could be of value in guiding the process. They could then assist in designing the appropriate strategy, implementing the best software and assuring that the preparation of the compliance report is in the correct order.

Consultants could guide companies to make strategic decisions when planning for possible scenarios. If a company plans to acquire a company from a different industry or a much smaller company, they can guide companies towards creative ways to achieve the ideal transfer pricing outcome.

Disputes

Companies need to meet the requirements of tax authorities. The guidance from transfer pricing consultants on tax policies and required documentation could help companies avoid tax disputes. Its like taking a lawyer to court – having the right guidance on the companies side could safe the company from unnecessary complications while also building trust with the authorities.

Conclusion

Most parts of the transfer pricing process could be solved by using the correct software. The automation of the transfer pricing process makes it easy and efficient. When there are disputes or changes in strategy consultants can give good guidance to protect your company.

The software gives your company the advantage to have all reports available in a cloud in case of an audit. Although the transfer pricing software may call for a bigger initial investment to install the software and train the employees, it will be more efficient in saving time and money in the years after the investment.

Sources:

https://www.oecd.org/tax/beps/beps-actions/action13/

Szotek-Ververken, P.M. (2020), Multinational Enterprises, European State Aid and Transfer Pricing

Wilkins (1970), The Emergence of the Multinational Enterprise: American Business Abroad from the Colonial Era to 1914, Cambridge, MA: Harvard University Press.

Recent Comments