Transfer Pricing Blog

The Future of Transfer Pricing is AI-Driven and Here’s Why

AI is opening up new possibilities for transfer pricing. It’s not just about keeping up with compliance anymore, it’s about moving faster, working smarter, and getting more value from your data. Tax teams around the world are starting to embrace AI to make their lives...

Now Live in TPGenie: The German Transfer Pricing Transaction Matrix

TPGenie continues to lead the way in streamlining global transfer pricing compliance — and we’re excited to announce our latest enhancement: the full implementation of the German Transfer Pricing Transaction Matrix. Designed to meet the latest requirements set by the...

Can AI Really Understand the Arm’s Length Principle?

AI is no longer a “nice to have” in transfer pricing, it’s already here, reshaping how tax teams handle documentation, benchmarking, and risk monitoring. Many multinational enterprises (MNEs) are well on their way to integrating AI into their TP processes, using it to...

The Future of Transfer Pricing AI: How Artificial Intelligence and Data Are Transforming Global Tax Compliance

As global tax regulations grow more complex, the world of transfer pricing is undergoing a major transformation—powered by artificial intelligence. From real-time compliance to machine-readable filings, transfer pricing AI is not only changing how we document, but...

Say Goodbye to TP Documentation Headaches

Imagine creating transfer pricing documents that practically write themselves. That's exactly what our April 2025 update at TPGenie delivers. The Template Revolution is Here Remember the old days of endless copying and pasting between entity files? The tedious hours...

TPGenie Users Day 2025: Collaboration, Innovation, and the Future of Transfer Pricing Technology

Last week, we had the pleasure of hosting the TPGenie Users Day 2025, bringing together transfer pricing professionals from across the globe for a day of learning, sharing, and collaboration. The event, generously hosted at H&M's premises by Rika Yamane and Erik...

Data and Technology in Transfer Pricing: Transforming Compliance and Strategy

In today’s interconnected world, data and technology are revolutionizing the way multinational enterprises (MNEs) approach transfer pricing. The increasing complexity of global regulations, coupled with the need for transparency and efficiency, has made leveraging...

Regulatory Changes and Audits in Transfer Pricing: Staying Ahead of Compliance

Transfer pricing continues to be a top priority for tax authorities worldwide, with regulations evolving and audit scrutiny intensifying. For multinational enterprises (MNEs), compliance is no longer just about ticking the right boxes, it requires a proactive,...

Global Transfer Pricing Disputes: Navigating Complex Challenges

Transfer pricing disputes have become a critical area of focus for multinational enterprises (MNEs) as tax authorities worldwide ramp up their scrutiny of intercompany transactions. These disputes, often arising from differing interpretations of the arm’s length...

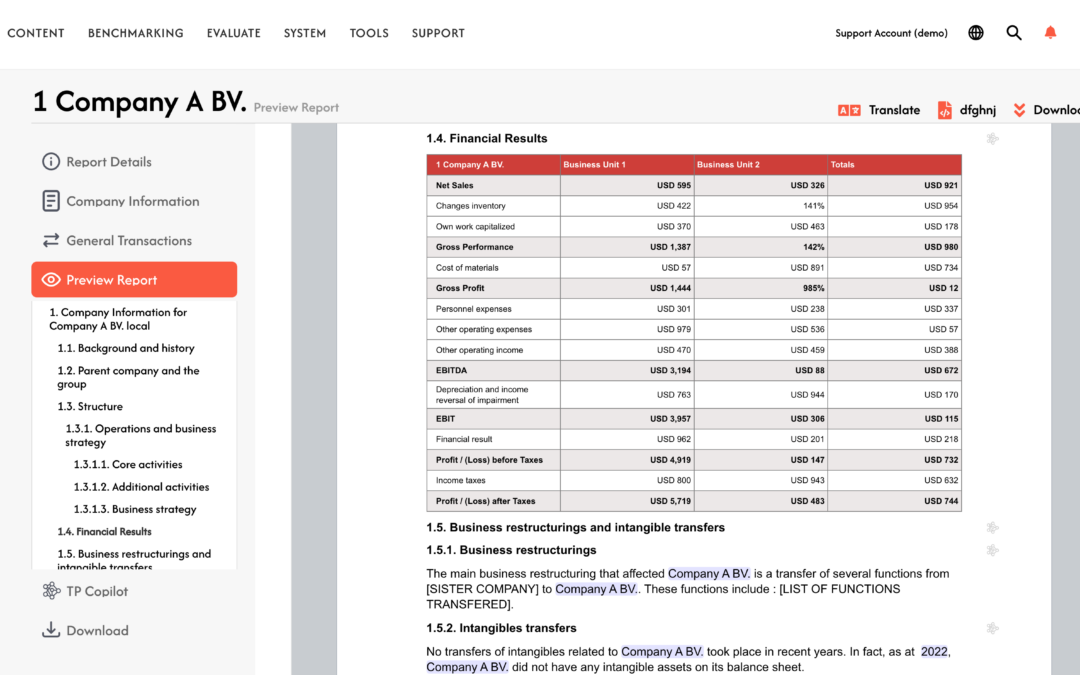

New P&L Segmentation Feature Makes Transfer Pricing Documentation Easier

P&L Segmentation Tool The P&L Segmentation Tool enables organisations to build, manage, and populate segmented Profit & Loss statements within TPGenie. This module helps structure financial data across multiple dimensions like product lines, business...