As global tax regulations grow more complex, the world of transfer pricing is undergoing a major transformation—powered by artificial intelligence. From real-time compliance to machine-readable filings, transfer pricing AI is not only changing how we document, but what documentation even looks like.

In this blog, we’ll explore the future of transfer pricing compliance—fueled by AI and structured data—and break it down into short-term, mid-term, and long-term trends that every multinational and tax professional should prepare for. We can help you transitioning to a Transfer Pricing AI fueled eco system using our Transfer Pricing Copilot software solution.

Short-Term (Today to 2 Years): Transfer Pricing AI as a Smart Assistant

We’re already in the first phase of the transfer pricing AI revolution. Today’s AI tools help tax professionals:

-

Review transfer pricing documentation for missing sections or inconsistent narratives

-

Check compliance with OECD guidelines and local regulations

-

Generate draft TP reports using structured data and pre-set logic

-

Flag red flags before submission with real-time risk indicators

But there’s a parallel transformation happening: the format of TP documentation itself is evolving. Tax authorities are introducing structured TP forms—such as the recently updated Belgium 275.LF Form, India’s Form 3CEB, and Poland’s TPR-C—moving away from long, narrative-heavy local files.

These forms are machine-readable, making them ideal for AI-driven transfer pricing analysis and future automation.

Medium-Term (3 to 5 Years): Standardized Data, Predictive Audits, and Government AI

In the near future, transfer pricing AI won’t just assist—it will audit, analyze, and even anticipate. Governments will begin to:

-

Use AI to cross-check transfer pricing forms, CbCR reports, customs data, and APAs

-

Simulate audit scenarios and flag risk-prone entities automatically

-

Trigger investigations based on real-time anomalies in structured TP data

In parallel, corporate tax teams will rely on AI-based transfer pricing platforms that:

-

Monitor legislation changes across jurisdictions, such as the TPGenie Compliance Tracker

-

Update TP templates and disclosures based on current rules

-

Validate consistency across local files, master files, and financials

This era marks the rise of intelligent compliance—where transfer pricing AI ensures alignment between narrative justifications and the actual numbers submitted.

Long-Term (5 to 10 Years): Autonomous TP Engines and Machine-to-Machine Filing

A decade from now, the landscape of transfer pricing will be drastically different. Here’s what AI in transfer pricing will make possible:

-

Autonomous systems that generate, update, and file TP documentation in real-time

-

AI agents that negotiate routine APAs directly with government bots, based on historical pricing patterns

-

Blockchain technology ensuring traceable, immutable TP filings

-

API-based interactions where governments and companies exchange structured transfer pricing data instead of narrative reports

Tax documentation will become continuous rather than annual. Your transfer pricing AI tool will update margins, test results, and economic analyses as data flows through your ERP or accounting systems.

And instead of long PDFs, tax authorities will request tagged data formats—JSON, XML, or XBRL—that can be ingested by their own AI systems for transfer pricing enforcement.

The Big Shift: From Narrative to Data-Driven Compliance

The most profound shift? Transfer pricing documentation is becoming data-first. We’re moving to a hybrid model:

-

80% structured data (transaction values, counterparty info, PLIs, risk flags)

-

20% narrative explanations (summaries, strategy, exceptional cases)

This structure is critical for transfer pricing AI to function effectively. AI systems thrive on clean, structured inputs—making narrative-heavy reports harder to analyze, compare, and validate.

Strategic Takeaway: Why Transfer Pricing AI Matters

For multinational companies, the implications are clear:

-

If you’re still relying on Word-based TP reports, you’re falling behind, use our TPGenie Transfer Pricing Documentation solution to manage & create compliant Transfer Pricing Documentation.

-

Structured data enables faster compliance, more accurate reporting, and smarter audit readiness

-

AI in transfer pricing will soon become the norm, not the exception

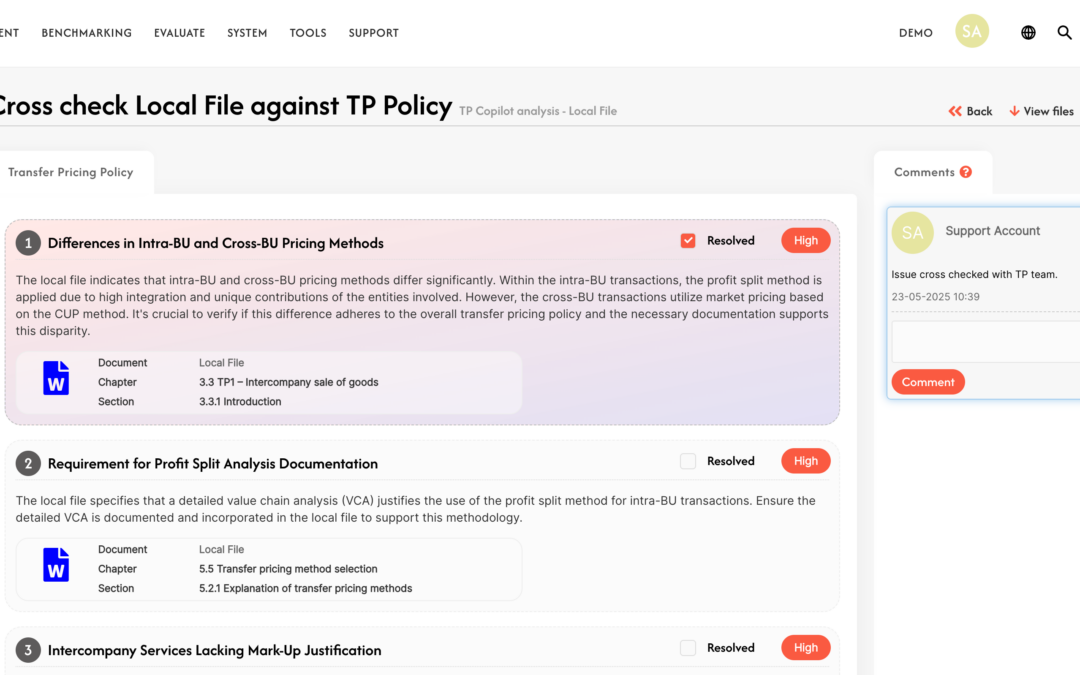

For SaaS providers and tax advisors, the opportunity is to build AI-ready systems: ones that connect directly to ERPs, generate machine-readable disclosures, and validate logic with AI before submission. In TPGenie all data structured and we are already developing AI tools such as the TP Copilot for validating and cross checking your local files and AI Benchmark for automated validation of benchmarking comparables.

Conclusion: Transfer Pricing AI Is the Future of Compliance

The transfer pricing world is evolving—and AI is leading the charge. From smarter document creation to real-time audit simulation and machine-readable filings, transfer pricing AI is no longer a futuristic concept—it’s becoming the foundation of intelligent tax compliance.

If you’re preparing your organization for the future, now is the time to invest in AI-powered transfer pricing tools that turn compliance from a burden into a strategic advantage.

Ready to explore how TPGenie can help your company leverage transfer pricing AI for smarter compliance? Get in touch with our team or schedule a demo today.

Recent Comments