Albert Einstein and taxes

Taxes has throughout the ages been a major point of debate. Every country has their unique way of collecting taxes. Leo Mattersdorf was the tax advisor for Albert Einstein. They once had lunch together where Einstein famously told Mattersdorf with a chuckle:

“The hardest thing in the world to understand is income taxes.”

Mattersdorf went on to say that Einstein’s relativity theory is much harder to grasp and I tend to agree with him, but this does not make the process of understanding taxes easy.

On Monday 12 December 2022, The National Law Review released an article on the Dutch tax changes for 2023. There are some interesting changes regarding corporate income tax, real estate transfer tax and the energy investment allowance. The fiscal unity system however remains unchanged.

What is a fiscal unity?

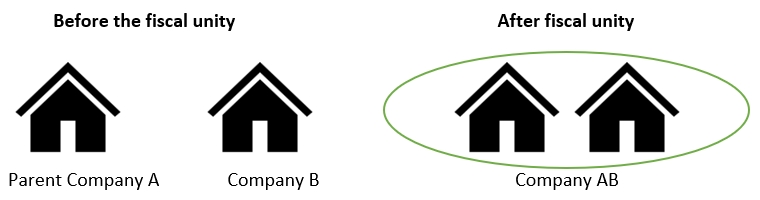

One of the focal points of the Dutch corporate income tax system is the fiscal unity regime. Dutch tax resident companies can opt in to be included in the fiscal unity system. This implies that these companies are generally treated as one taxpayer. This is mainly done for corporate income tax purposes. The companies that can apply must have at least 95% of shares in a Dutch tax resident subsidiary company. When parent and subsidiary companies opt in for the fiscal unity, they are no longer independently responsible for corporate income tax, but they function as a fiscal unity meaning that they function as one taxpayer.

An example: The Parent Company A acquires 95% shares in a subsidiary called Company B. They form a fiscal unity and then functions as one taxpayer.

The single most important aspect of the current fiscal unity system is that it treats all members of the fiscal unity as one singe taxpayer. This means that all liabilities, assets, losses and profits of the subsidiaries within a fiscal unity are attributed to the parent company. This implies that the profits of one company could be offset against the losses of another subsidiary company forming part of the fiscal unity. Under this system all inter-company transactions are ignored, with a few exceptions to prevent misuse and abuse.

Which companies can qualify?

In general, a fiscal unity is restricted to companies that are resident in the Netherlands on the basis of their place of effective management (and that are not resident outside the Netherlands under an applicable tax treaty or similar arrangement). Resident companies that are incorporated outside the Netherlands need to satisfy additional criteria (e.g. have a corporate form equivalent to Dutch companies). Subject to meeting certain conditions (e.g. as regards place of effective management, corporate characteristics et cetera), Dutch permanent establishments of non-resident companies may be included in a fiscal unity. A permanent establishment can also function as the parent company, provided that the shares in the subsidiaries are attributable to the permanent establishment.

European pressure

In recent European case law, the current Dutch fiscal unity system had to be adjusted in order to comply with European law. The adjustment meant that certain legislation within the fiscal unity system needed to be changed. The adjustment is known as the per-element approach, and this have put the fiscal unity system under more pressure as it creates practical issues against the European law. Replacing or amending the law has been on the table for a while now.

Major benefits

The fiscal unity makes it possible for companies to set off the results against each other. Transactions within the fiscal unity like post acquisition reorganizations and the sale of assets are not recognized for Dutch corporate income tax purposes. This implies that these transactions can take place on a tax neutral basis.

In terms of sales tax, the transactions between parent and subsidiary companies are not charged. This could be beneficial for liquidity as the holding company will not pay VAT on the invoices sent to the subsidiaries. The fiscal unity only needs to file one corporate income tax return under the name of the holding company. The annual accounts between the subsidiaries still however needs to be drawn up. It is also possible to arrange tax-free restructuring between the parent company and its subsidiaries within the fiscal unity.

Solution

TPGenie was already for years equipped with functionality that allows reporting a fiscal unity (fiscale eenheid in Dutch) accurately. In our most recent software update of May 2020, we have improved the functionality to make it more versatile to the needs of various multinational companies and countries. Therefore, we have improved flexibility by adding options to show, hide, or aggregate internal intercompany transactions.

Sources:

https://research.tilburguniversity.edu/en/publications/dutch-fiscal-unity-regime-under-eu-fire-will-the-regime-survive

https://www.natlawreview.com/article/re-struc-tax-changes-2023

Recent Comments