Transfer Pricing Benchmarking Database

Benchmarking Database

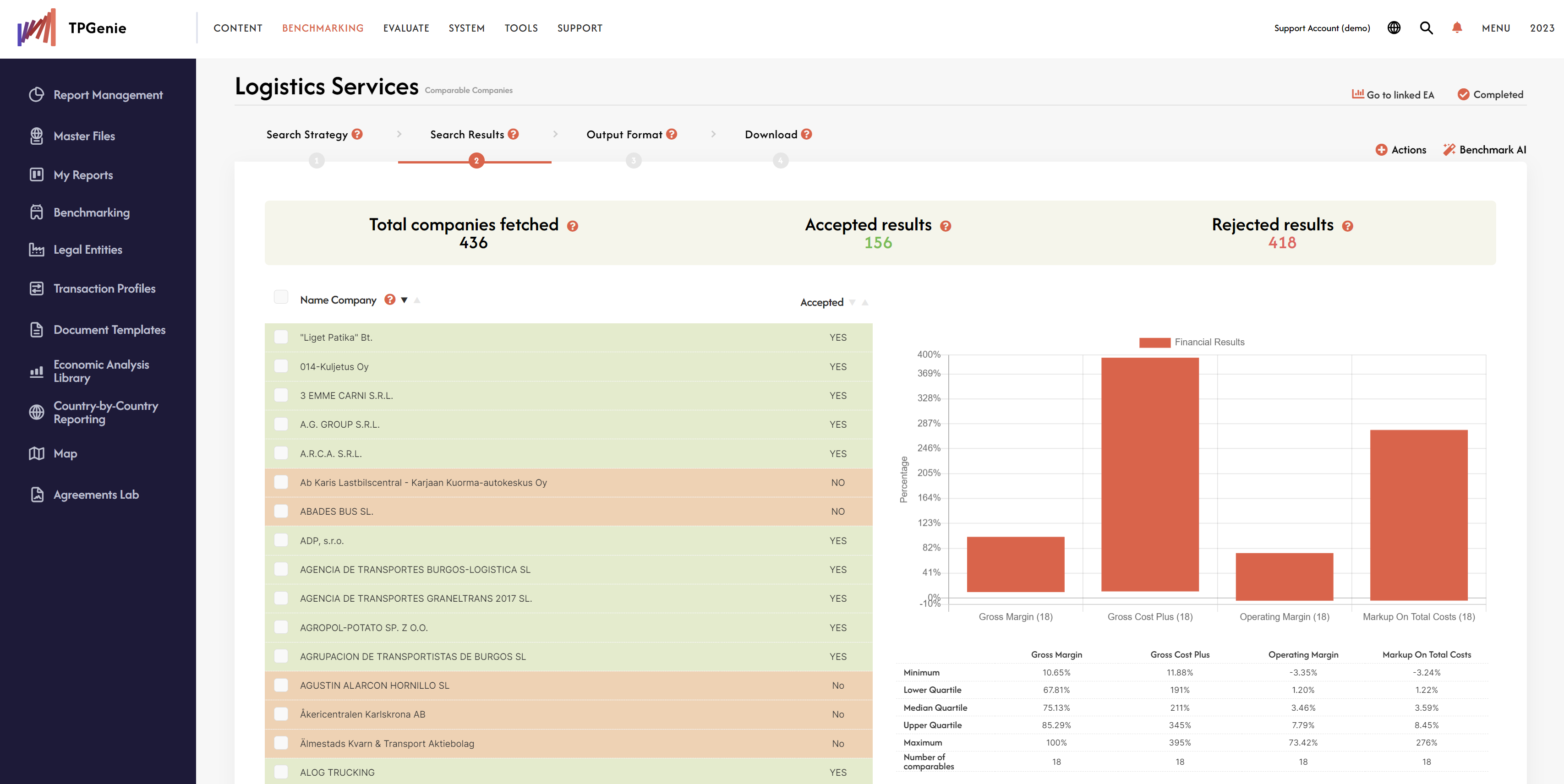

The Transfer Pricing Benchmarking Database is a module which takes the complicated process of performing an economic analysis off your hands: it provides high quality benchmarking studies in few easy steps. It simplifies transfer pricing analyses, including profit and transaction-based analyses.

No need anymore to purchase expensive databases and then spend hours or even days on analysing the raw data.

We got you covered here.

As a tax advisor, MNE or Local Entity, you can create your benchmarks by making arm’s-length analyses for tangible and intangible intra-group transactions, intra-group services and intra-group financing. The tool eliminates the need to purchase data from external data providers and makes searching easier thanks to pre-selected results. All comparable companies or agreements in the database are thoroughly checked by our experts. The results can be integrated directly with your transfer pricing documentation tool TPGenie.

You can use our Benchmark AI features to automatically crawl & retrieve detailed company information information. You can achieve a 95% accuracy rate in automatically accepting or rejecting your search results with the use of TPGenie Benchmarking AI!

The Transfer Pricing Benchmarking Database consists of four search engines. Each of them can be utilised for a different set of results:

- Upload an external benchmark from a third-party provider, such as Orbis by Bureau Van Dijk or D&B.

- Comparable Companies in Europe, Eastern Europe, Asia and North America: Establish at arm’s-length remuneration using TNMM, Resale Minus and Cost Plus methods;

- Intermediary Financing Remuneration: Establish at arm’s-length remuneration for companies involved in Intermediary Financing and Cash Pooling activities using CUP method;

- Interest Rate: Establish at arm’s-length Interest Rate on Intercompany Loans using CUP method;

How does the Transfer Pricing Benchmarking Database work?

The Transfer Pricing Benchmarking Database can be utilised in two different ways:

- Integrated: As a multinational or as a local entity. The results such as Benchmark Excel can be directly included in your Local file for your entity(ies).

- Standalone: As a tax advisor. The system creates a package of files such as write-ups and Benchmark Excel which can be be shared with your clients.

The output can be fully customised to your needs including adding your corporate branding and company logo.