Compliance with transfer pricing regulations across multiple countries presents a complex challenge for organizations operating and planning to expand internationally. This requires careful navigation in understanding diverse regulatory landscapes and meeting all the necessary deadlines.

Intra Pricing Solutions offers an All-in-One Transfer Pricing Documentation Software called TPGenie, which specifically features a built-in compliance tracker. This tool empowers multinational companies to stay on top of diverse regulations and deadlines worldwide, providing them with valuable insights to streamline their operations effectively. The compliance tracker enables companies with the following:

TPGenie’s automated calendar system

Utilising the TPGenie compliance tracker streamlines transfer pricing compliance by integrating an automated calendar system. The tool automatically sends reminders and updates to the relevant users in the tool. This ensures timely reminders and updates for deadlines across jurisdictions, mitigating the risk of fines and suspicions of tax evasion. Proactive adherence to deadlines not only demonstrates diligence but also promotes operational efficiency, minimising errors and costly rework while fostering transparency with tax authorities.

The compliance tracker provides country-specific transfer pricing requirements, including specific deadline dates, URLs for country portals and information on your companies transfer pricing status in meeting the deadlines. The compliance tracker provides generic data sourced from third-party resources. However, we offer a feature that allows you to overwrite this data with your group’s specific information, tailoring it to meet your TP policy. For example, if your company has specific needs in Germany, you can input this information into the compliance tracker. Simply click on the field, update the data, and store your customised group information.

Helping to get a grip on global transfer pricing compliance

Tax authorities worldwide are intensifying their scrutiny of transfer pricing, heightening the risk of audits and investigations. Failure to comply with transfer pricing regulations can result in hefty penalties, fines, and back taxes. Achieving compliance requires significant administrative effort and a strategic approach to documentation policies and procedures. The following aspects are covered by the compliance tool ensuring that your company meet the global documentation requirements:

- Country Overview: Provides information on your company’s presence and general details about the specific country.

- Master File: Contains completion status, deadline date, and description for your company’s compliance.

- Local File: Provides completion status, document necessity, required language, deadline date, and description for your company’s compliance.

- Country-by-Country Reporting: Provides completion status, document necessity, notification deadline and description, as well as report deadline and description for your company’s compliance.

- Pillar Two: Income Inclusion Rule, Undertaxed Payment Rule , Qualified Domestic Minimum Top-up Tax, Transitional Safe Harbour, Safe Harbour, Status of Enactment Pillar Two plans announced.

- Transfer Pricing Form: Offers information on country-specific TP forms, their deadlines, and descriptions.

- Statutory Filings: Provides information on financial account status, corporate tax deadlines, filing status, and CIT rate for each country.

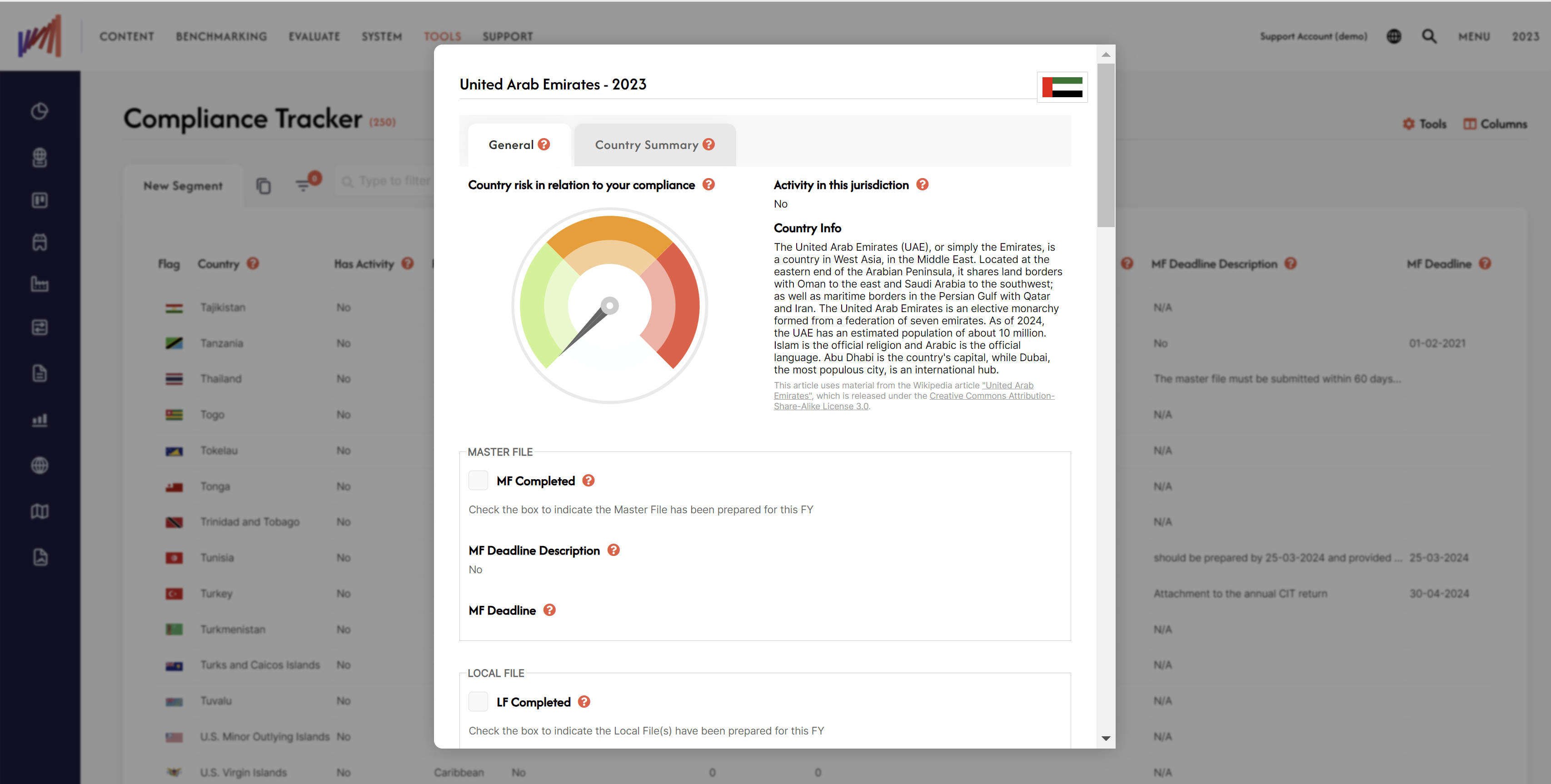

Below is an example of how the Master file section would look in the compliance tracker tool:

Country summary – Navigating global transfer pricing regulations

In addition to the mentioned features, every country section includes a ‘Country Summary.’ This section offers general transfer pricing details based on OECD guidelines but also allows you to customise it with your own text pertaining to transfer pricing legislation in that specific country. You have the flexibility to replace the default content with your own information. This empowers organizations to vigilantly monitor updates and amendments in transfer pricing regulations within their operational areas.

Below is an example of how the first part of the transfer pricing country summary will look for the United Arab Emirates:

How TPGenie can assist

TPGenie serves as the ultimate solution to alleviate the burdens associated with transfer pricing adjustments, thereby minimizing tax risks. Our software empowers organizations by automating the creation and upkeep of transfer pricing documentation, effectively eliminating headaches and ensuring compliance with ease. With TPGenie’s cutting-edge compliance tracker tool, managing transfer pricing deadlines becomes a seamless process, allowing businesses to focus on their core operations with confidence and peace of mind.

Recent Comments