The Pillar Two regulations, part of the OECD’s Global Anti-Base Erosion (GloBE) framework, require multinational enterprises to calculate and report global tax liabilities. With this, the need for Pillar Two software has emerged, designed to streamline the process of filing GloBE Information Returns (GIR).

Pillar Two Software

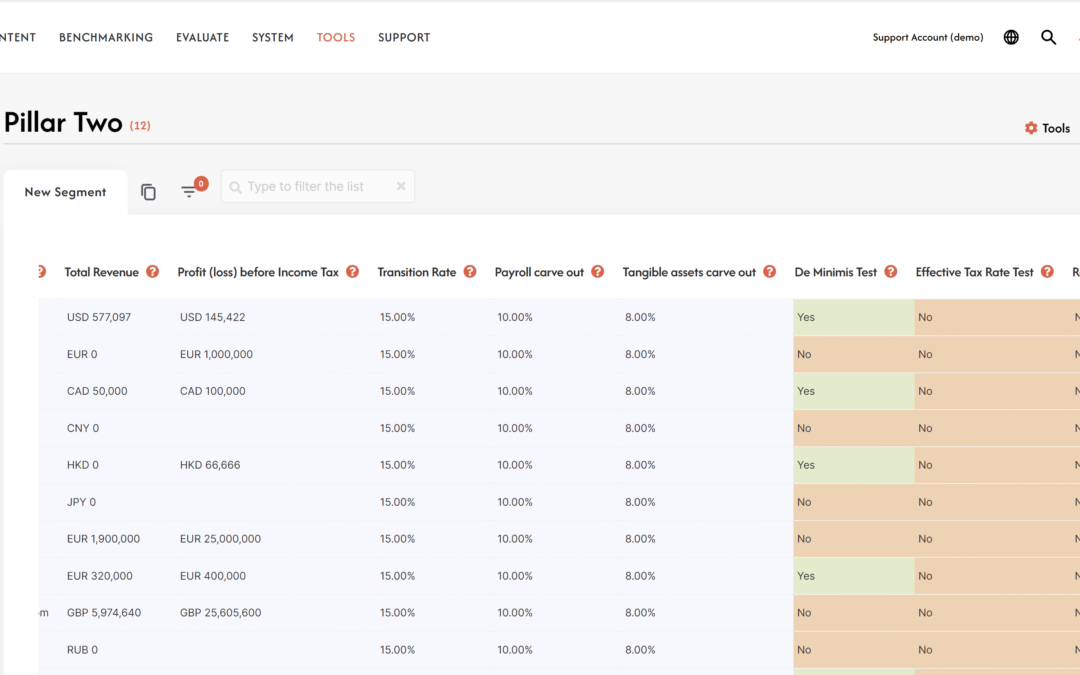

Pillar Two software solutions help multinational enterprises comply with GloBE rules, which aim to prevent profit shifting by ensuring a minimum effective tax rate across jurisdictions. These tools automate the data collection, calculation, and filing of tax reports, including essential elements such as:

- Message Headers: Details of the sender, recipient, and report type.

- Identification Numbers (TIN/ID): For constituent entities, parent companies, and tax filings.

- GloBE Body: Core tax calculations for each jurisdiction, including income, exclusions, and top-up tax computations.

Why You Need Pillar Two Software

Complying with Pillar Two regulations requires complex data management and precise reporting. Pillar Two software provides solutions to streamline this process by:

- Automating the collection of financial and tax data from multiple jurisdictions.

- Standardising reporting with the GloBE XML schema.

- Ensuring compliance with the OECD’s inclusive framework.

As global tax reporting grows in complexity, Pillar Two software helps companies reduce errors, improve transparency, and meet their regulatory obligations efficiently.

Features to Look for in Pillar Two Software

When selecting a Pillar Two software solution, look for the following features:

- XML Schema Compliance: Ability to structure reports according to the OECD’s XML schema.

- Automated Filing: Facilitates timely and accurate tax return submissions.

- Flexible Integration: Can be integrated with existing financial systems to gather required data.

- Jurisdictional Customisation: Adjusts for different rules in each tax jurisdiction, including safe harbour provisions and local tax regulations.

The Future of Tax Reporting

As the OECD’s Pillar Two regulations are adopted globally, Pillar Two software will become essential for large multinational corporations. These tools will not only ensure compliance with global tax regulations but will also help businesses manage their tax exposure in a transparent and consistent way.

Adopting the right software is crucial for staying ahead in the rapidly evolving global tax landscape, ensuring that you meet your obligations under the Pillar Two framework. Click below to see more information about out Pillar Two tools:

Recent Comments