Multinationals are obliged to be in the possession of a list of ICAs (intercompany agreements), which serve as a supporting document to transfer pricing documentation and the tax position. TPGenie is recently updated with an inter-company agreements module. The module provides you with the ability to easily manage ICAs within a central environment in which creating or updating documents is made possible in a clear and efficient manner.

The intercompany agreements module consists of the following functionality:

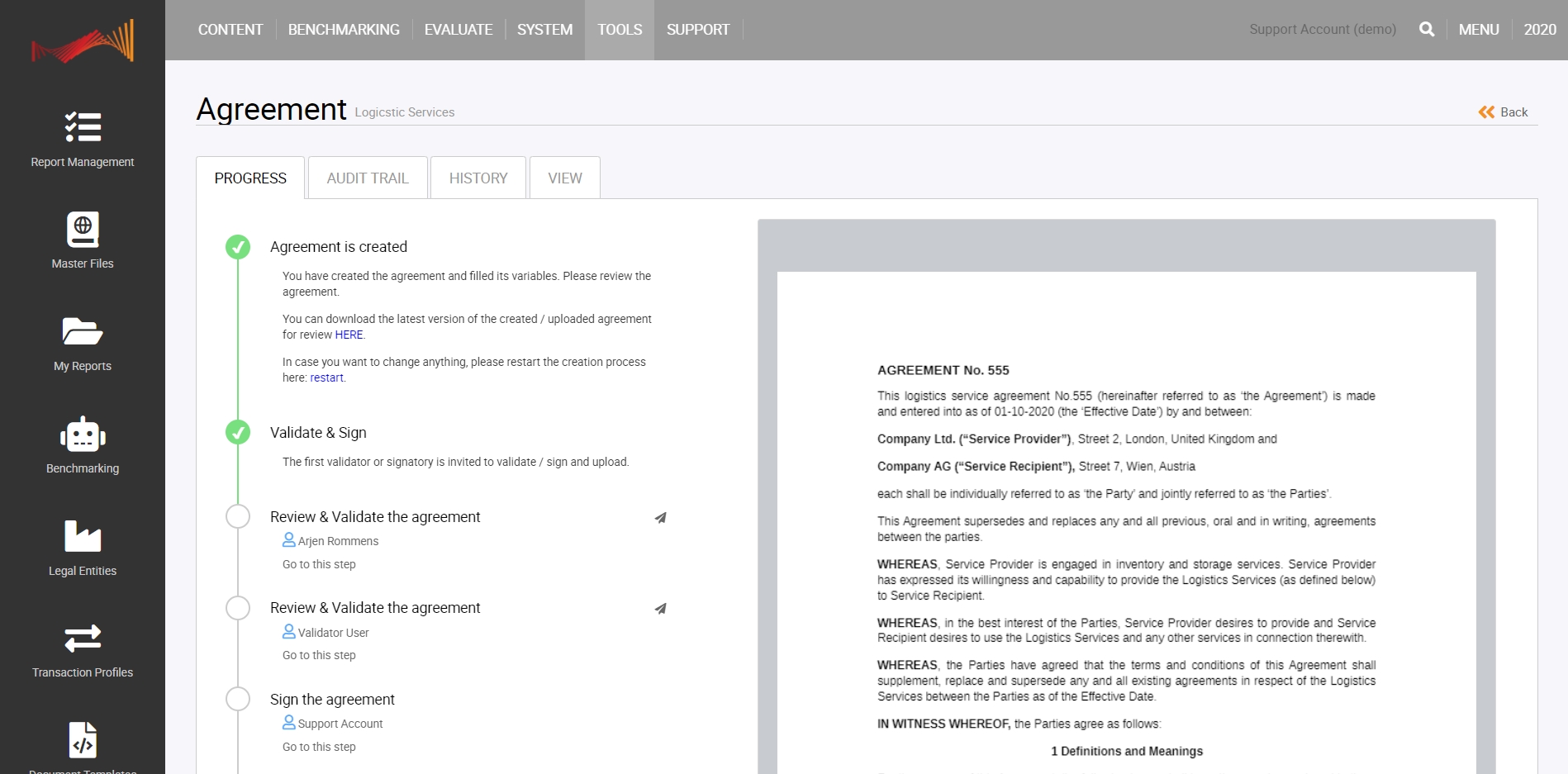

- A library containing all intercompany agreements where agreements can be uploaded and characterised by entering metadata.

- A dashboard displaying the overview of all available agreements where agreements can be uploaded and validated on a central level. For example by your legal department.

- Integration with with your transfer pricing workflow.

- Automatic notifications sent by email to inform counter parties and/or your legal department when information is updated or agreement’s due date is reached.

- Output generation of the package where agreements are identified and included in the final transfer pricing documentation.

- An overview of missing agreement, to quickly identify and mitigate potential risks.

Why using the module?

- It provides the best overview for your intercompany agreements. You will know if one is missing or when they require updating.

- With your intercompany agreements module being compliant is a lot easier and reduces the risk of transfer pricing related penalties.

- No more spending a lot of time looking for the right intercompany agreement.

- The inter-company agreements module is easy to use.

- The inter-company agreements module is safe to use. Access can be restricted and only the relevant inter-company agreements can be shown.

Recent Comments