A challenging year

We are fast approaching the end of a challenging 2022. We can approach 2023 with energy and zeal, but history have teached us that challenges are inevitable. The American financier and statesman Bernard Baruch famously said:

“The art of living lies less in eliminating our troubles than in growing with them.”

The economic situation most companies and countries find themselves in is one where we need to deal with high inflation. The rise in inflation is mainly caused by the still concerning situation around the war in Ukraine, the rise in energy prices, rising consumer demand after the Covid-19 pandemic and supply chain issues stemming from the pandemic.

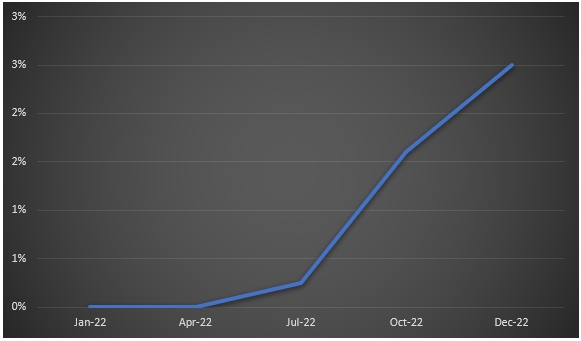

Central banks around the world have countered with increasing benchmark interest rates. The implication of this counter directly influences intra group transactions. In the Netherlands the benchmark interest rate has climbed from around 0% in the beginning of 2022 to 2,5% at the end of the year.

The benchmark interest rate in Netherlands (2022)

Higher interest rate implications

The recent surges in interest rates and the volatility in the financial markets have changed the risk equation. This volatility causes transfer pricing risks to be under great attention as further increases may be expected in 2023. The higher interest rates however could also favour group arrangements from third party lenders, but this could lead to more complex arms-length considerations.

The higher interest rate benchmark would imply that funding cost has risen. The adjustment in the cost of financing must ideally filter through to inter group funding arrangements. It is essential that the new market interest rates must be reflected in the upcoming transactions. When adjusting the interest rate concluded between the parties related, it is important to pay attention to check if all the loan agreements are market based and to check if the interest rate of transactions does not exceed the maximum allowable interest rate.

Why is benchmarking needed?

In short, the increase in the interest rate also impacts the financing transactions between business subsidiaries. Related parties have to ensure that the agreements and arrangements continue to be in line with the market conditions. In volatile market conditions transfer pricing solutions could be of great value.

To prepare for market changes companies can arrange their in-house transfer pricing policy in such a way that it can withhold the storm. The reason why companies would do this is for accurate transactions with related parties, easy ways to document transactions and more accurate data in for the manager working with transfer pricing risk.

Sources

- European Central Bank

- The Economis

- DLA Piper

Recent Comments