Transfer Pricing Blog

Top 10 Transfer Pricing Documentation Tools in 2026

In 2026, transfer pricing compliance has entered a new era. While BEPS Action 13 and Local/Master File obligations remain the foundation, Artificial Intelligence, LLMs, MCP-readiness (artificial intelligence plugins), and the full implementation of Pillar Two,...

What Are TP Forms?

Transfer Pricing (TP) forms are mandatory tax disclosure forms that multinational enterprises (MNEs) must file with local tax authorities to report how transfer pricing rules are applied within their group. These forms are designed to give tax authorities structured,...

The Best Alternative to the EY Global Transfer Pricing Documentation Solution: A Complete Comparison with TPGenie

The transfer pricing technology landscape is changing quickly. Many multinational groups have worked with EY’s historic documentation platforms such as EY TPweb and EY TP Doc Manager, but EY is now promoting a more modern product: the EY Global Transfer Pricing...

Global CbCR Tax Portal Overview: 2025 Update

As we move through 2025, the digitalization of tax compliance continues to accelerate. TPGenie remains at the forefront with powerful Country-by-Country Reporting (CbCR) features and services. Beyond data gathering, KPI-based risk analysis, and CbCR XML generation,...

Turning TPGenie into an AI Agent: The Next Evolution of Transfer Pricing Technology

For more than fifteen years, TPGenie has been built around a single mission: helping multinational enterprises manage transfer pricing in a structured, auditable, compliant way. Over time we developed documentation engines, benchmarking tools, reconciliation modules,...

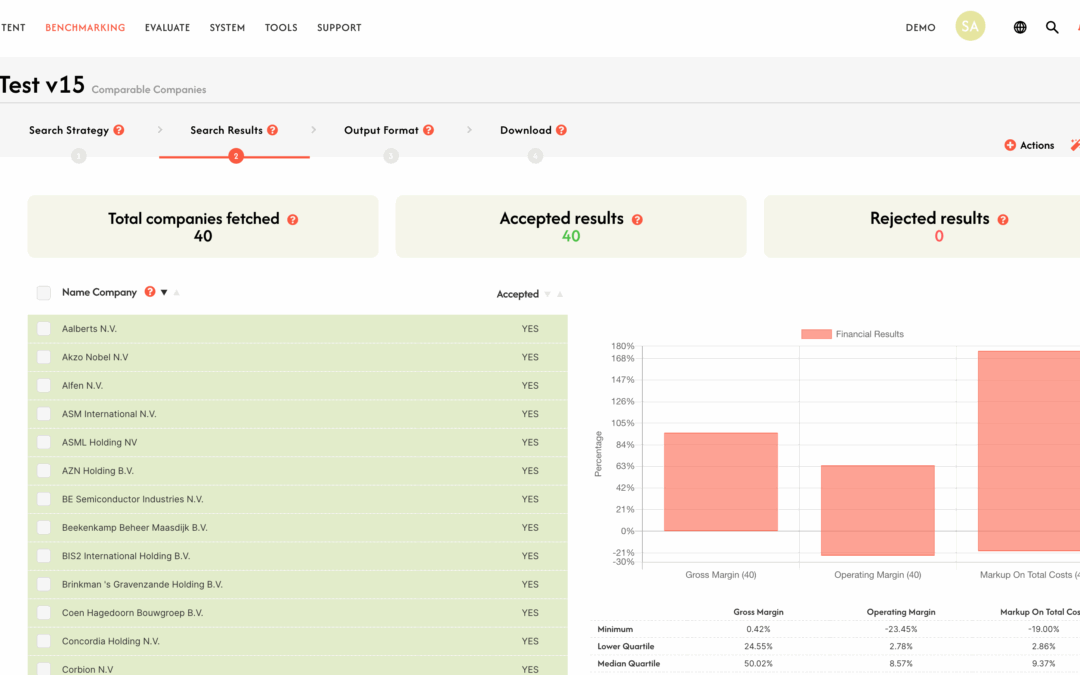

Unlocking Comparable Companies for Transfer Pricing – A Smarter Alternative to Bureau van Dijk

When it comes to arm’s-length benchmarking in a transfer-pricing context, many professionals turn to large commercial databases. But is there a leaner, more affordable solution built specifically for TP? At Intra Pricing Solutions we developed the TPGenie Benchmarking...

AI in Transfer Pricing: Benchmark AI Redefines the Future of Transfer Pricing Benchmarking

AI is reshaping how multinational enterprises approach transfer pricing. As tax authorities demand greater transparency and consistency, AI in transfer pricing has become a powerful tool for improving the accuracy and defensibility of benchmarking studies. Manual...

TP Copilot: Using AI to Cross-Check Local File with CbCR

One of the most common risks in transfer pricing documentation is inconsistency between the Local File and the Country-by-Country Report (CbCR). While both serve different purposes, tax authorities increasingly compare these reports side by side to identify red flags....

TP Copilot: More Than Validation – Your AI Partner for Transfer Pricing Compliance

In transfer pricing, details matter. A small mismatch between a TP Form and a Local File can trigger extensive audits, fines, and countless hours of extra work. With documentation spread across multiple files, entities, and years, even the most experienced tax teams...

TPGenie Compliance Tracker: Expanded with New FY2025 Data Fields

At TPGenie, we continuously enhance our platform to give multinational enterprises (MNEs) and tax professionals the tools they need to stay on top of ever-evolving global transfer pricing and tax compliance requirements. As part of our latest update, we have...