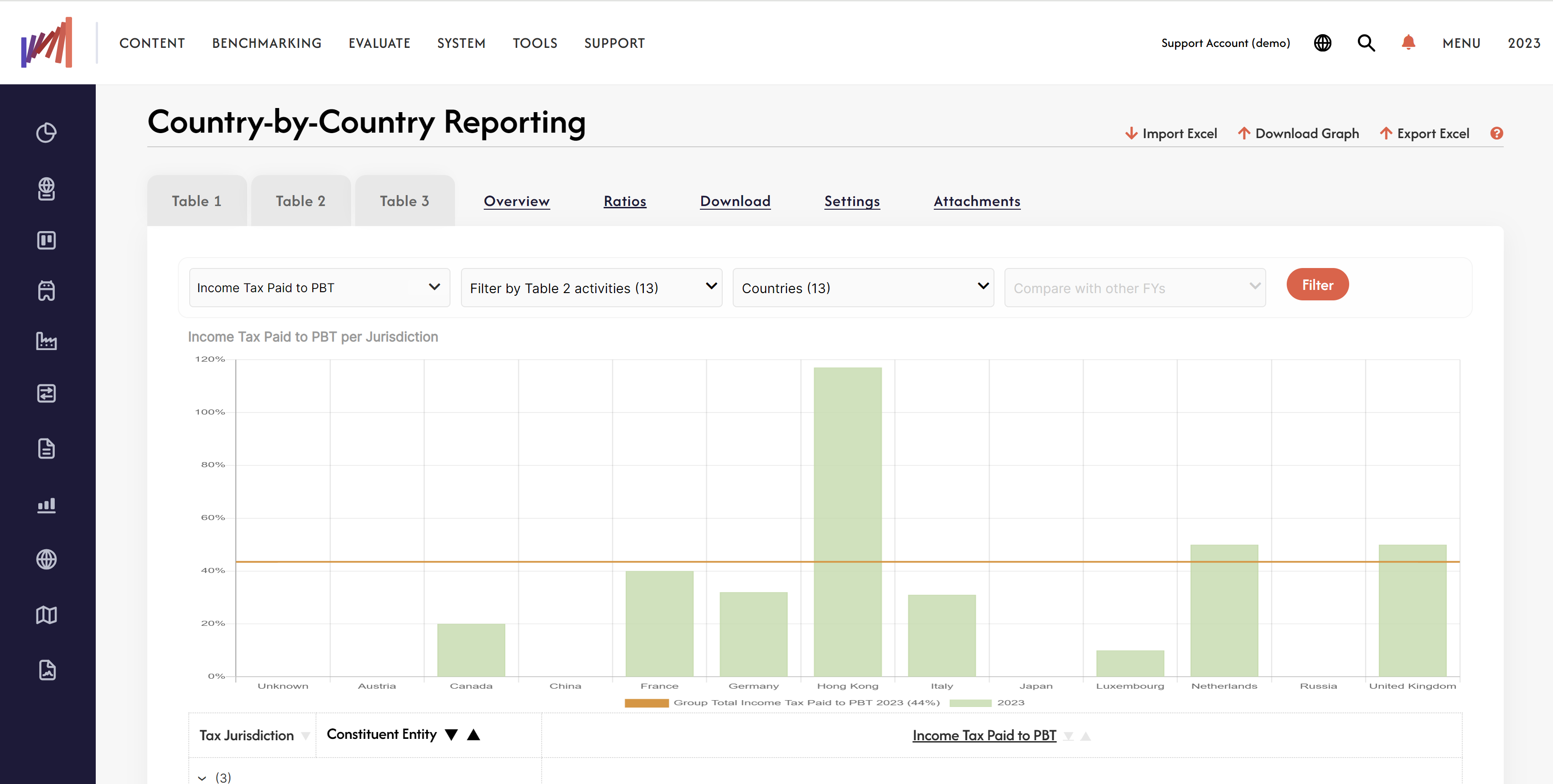

As we move through 2025, the digitalization of tax compliance continues to accelerate. TPGenie remains at the forefront with powerful Country-by-Country Reporting (CbCR) features and services. Beyond data gathering, KPI-based risk analysis, and CbCR XML generation, our software streamlines the final mile: submission.

Filing requirements have evolved significantly over the last few years. Many jurisdictions have migrated from simple email submissions to dedicated AEOI (Automatic Exchange of Information) portals or integrated “Online Services for Business” platforms. To assist your compliance teams, we have updated our community list of CbCR tax portals for 2025.

Below is the verified overview of CbCR tax portals by country:

CbCR Filing Portals (2025 Edition)

How about your CbCR Submission?

Navigating these diverse portals can be complex. To learn more about our CbCR tool and its repository features—including automated data validation and XML generation compatible with these portals—click the button below.

Schedule a demo

Recent Comments