Transfer Pricing Copilot

TP Copilot

Experience the future of transfer pricing with TP Copilot, an AI-Powered validation Module. TP Copilot integrated with TPGenie enhances transfer pricing by automating compliance tasks, identifying discrepancies, and providing real-time recommendations based on OECD guidelines and local legislation. Eliminate errors, and ensure compliance with cutting-edge AI technology. From detecting inconsistencies to cross-checking data and correcting grammar, our solution reduces biases, blind spots, and helps you stay ahead.

Features

Cross-Checks with External Files

Beyond reviewing Local and Master Files, TP Copilot automatically validates your transfer pricing documentation against externally generated deliverables. This ensures that all reports, forms, and agreements align seamlessly across your compliance landscape.

Key cross-checks include:

- Local File ↔ Country-by-Country Report (CbCR): Ensures consistency in revenues, FTEs, and business unit reporting.

- Local File ↔ TP Forms: Verifies that transactional and financial data match regulatory submissions.

- Local File ↔ Intercompany Agreements & APAs: Confirms that described transactions align with signed agreements and approved advance pricing arrangements.

- Local File ↔ Appendices & Supporting Documents: Detects mismatches in financial data, functional analysis, and entity details.

- Year-on-Year Comparisons: Highlights changes across fiscal years to ensure continuity and flag unexplained deviations.

With these cross-checks, TP Copilot proactively identifies discrepancies before submission, reducing the risk of audit triggers, fines, or reputational damage.

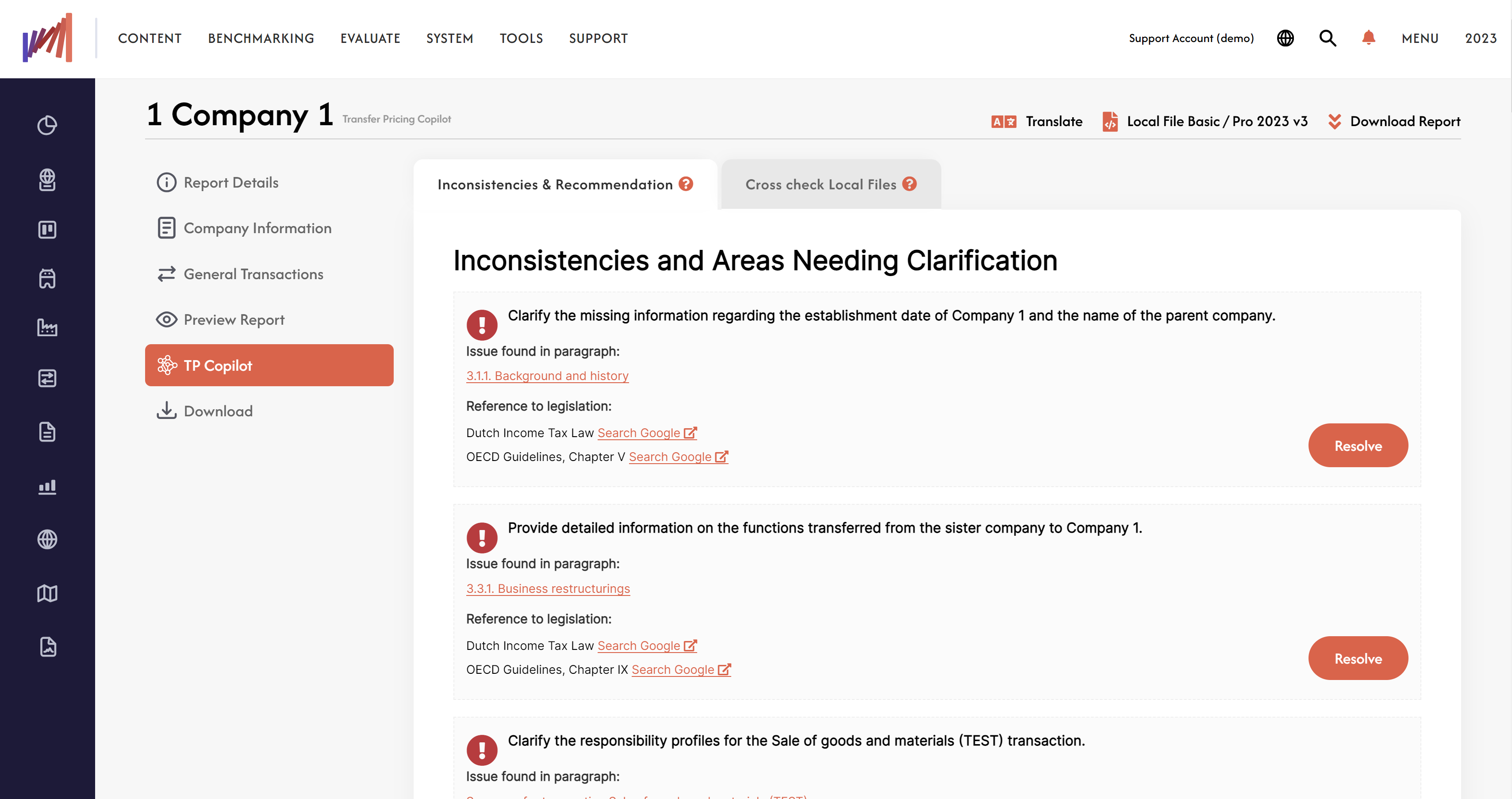

Local file Recommendations & Inconsistencies

TP Copilot integrated with TPGenie enhances transfer pricing by automating compliance tasks, identifying discrepancies, and providing real-time recommendations based on regulations. The following topics are covered:

- Identifies Inconsistencies & Provides Recommendations: Automatically flags discrepancies in your transfer pricing documentation and offers actionable solutions to ensure compliance with OECD guidelines and local legislation.

- Highlights Missing Information: Detects gaps in your data, ensuring that no critical details are overlooked in your Local Files.

- Grammar and Typos Correction: AI reviews your documentation for grammar mistakes and typographical errors, ensuring professional, error-free reports.

- Cross-Check Local Files: Compares Local Files across different entities and fiscal years to ensure consistency and avoid conflicting information.

- Real-Time Error Detection: Monitors data input and analysis in real time, catching errors or discrepancies before final submission.

- Eliminates Biases and Blind Spots: AI-driven insights help prevent human errors, ensuring an objective and thorough approach to transfer pricing.

Text completions in the editor

Text editor is extended with a ChatGPT-like function. This enables writing descriptions of functions, risks, and assets while preparing a Functional Analysis, and provide examples and guiding on how to do it correctly. The system can also retrieve summarised country-related data, making it easier for you to comply with local Transfer Pricing Regulations with minimum effort.

Writing assistant

TP Copilot also improves the accuracy and relevance of additional information used in Local files or Master files. This functionality acts as an additional writing assistant, helping you in formulating descriptions of functions, industries, MNE and company data.

Smart data import & ETL

Paste raw financial data and let AI transform data and flow it automatically into TPGenie.

TP Copilot runs on EU-based servers adheres to the strictest GDPR compliance standards. Data is securely processed and stored within the EU, ensuring that no unauthorised third parties have access to sensitive information.

“TP Copilot has proven to be a very helpful tool, generating accurate advice quickly. I’d rate it as a solid B+ in performance. It’s more efficient than the Excel-based processes I’ve used in the past. The consistency checks it offers are a great benefit, especially features like cross-checking between local files. It’s a tool that will definitely help many colleagues.”

For who is TP Copilot?

Tax Authorities

- Run red-flag checks on taxpayer documentation

- Benchmark functions, assets, and risks against industry peers

- Detect year-on-year changes in functions, risks, and transactions

- Pre-scan large batches of files to select high-risk taxpayers

Tax Consultants

- Efficiently review client deliverables

- Ensure template consistency and quality control

- Scope new clients quickly by scanning prior documentation

- Validate multi-jurisdictional consistency across files

- Shorten busy-season review cycles and increase client capacity

Multinational Groups

- Validate reports before submission

- Reconcile year-on-year financials and narratives

- Cross-check transaction values across counterparties

- Confirm appendices, APAs, and agreements are consistent

- Prepare for internal audits and governance reviews