Compliance Tracker

Compliance Tracker

Manage global transfer pricing compliance with TPGenie’s AI-driven Compliance Tracker. The module automatically updates country-specific tax and transfer pricing requirements by monitoring official government sources using AI. Customise local rules, automate risk assessments, and track deadlines for Master Files, Local Files, CbCR, TP Forms, and statutory filings. Stay fully aligned with the latest legislation, including Pillar Two developments, with continuously updated FY2025 data.

The AI-Driven Global Transfer Pricing Compliance Database for FY2025 and Beyond

Manage global transfer pricing and tax compliance with TPGenie’s Compliance Tracker. This module gives multinational enterprises and tax advisors a complete overview of country-specific transfer pricing obligations, filing deadlines, statutory requirements, and Pillar Two implementation rules — all updated automatically using AI.

The Compliance Tracker offers a complete overview of transfer pricing and tax-related obligations across all jurisdictions. It contains more than 75 tax and TP data points per country, giving MNEs and tax advisors a reliable, continuously updated picture of their obligations.

AI-Driven Updates from Official Sources

The Compliance Tracker is updated using an automated AI engine that monitors official government publications across all tax jurisdictions. This includes tax authority websites, legislative portals, gazettes, and other authoritative sources.

The AI continuously:

- crawls official publications,

-

detects changes in legislation,

-

compares new information to existing data,

-

and automatically updates the relevant fields in TPGenie.

All data is based strictly on verified official sources, enriched and compared through AI.

The module is included free of charge with every TPGenie license.

Key Features

Global Coverage

The Compliance Tracker covers all jurisdictions worldwide, with more than 75 data points per country.

Each country page includes statutory requirements, deadlines, URLs to tax authority portals, language requirements, and references to local legislation.

Customisable Data

Users can override default country data with group-specific information. Custom values are stored privately within your own environment. Typical customisations include:

-

Master File and Local File deadlines,

-

TP form requirements and statuses,

-

internal filing workflows,

-

entity-specific compliance statuses.

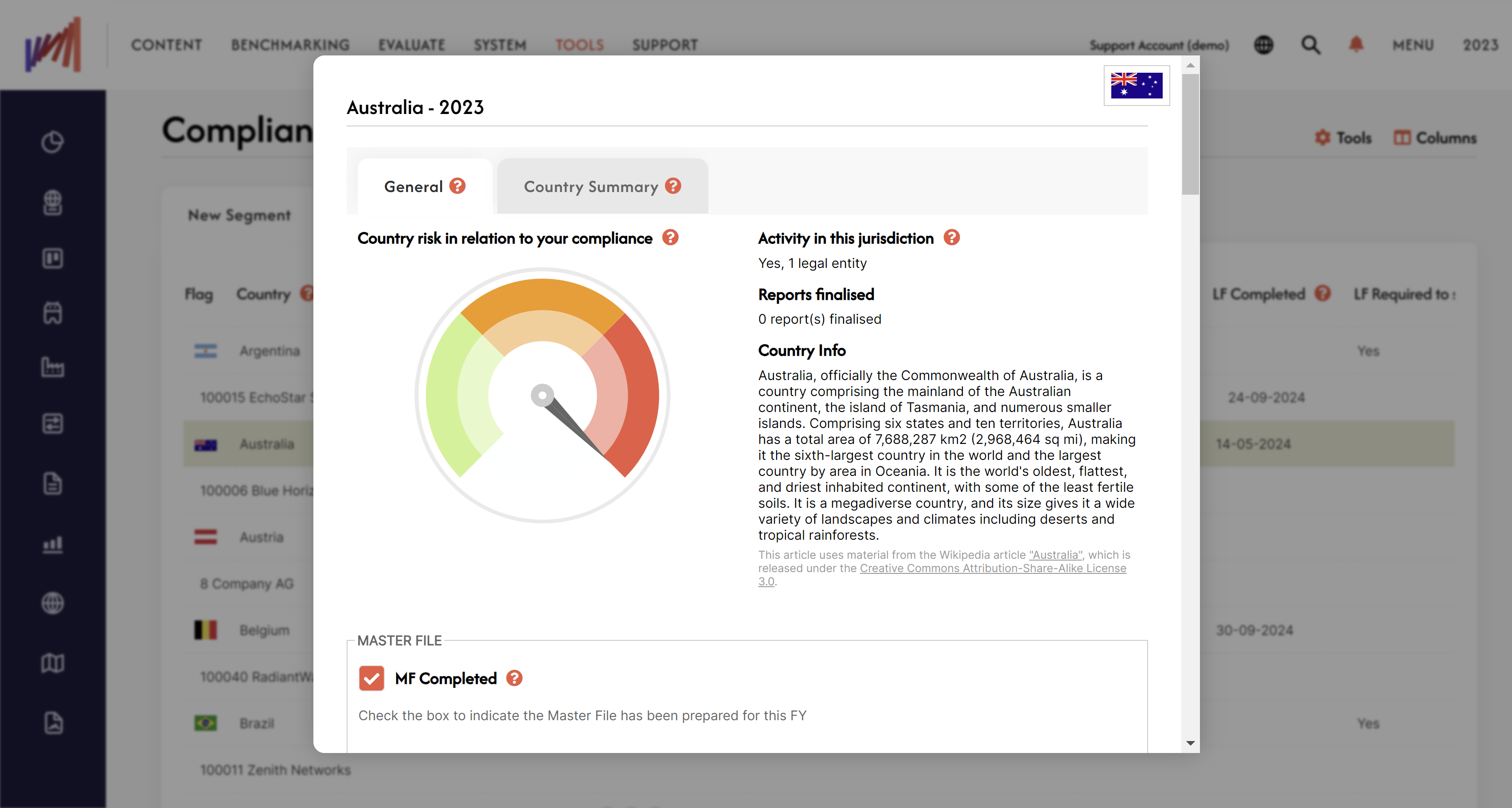

Automated Risk Assessment

The module provides a risk rating for each jurisdiction based on your group’s activities, helping identify high-risk countries early in the reporting cycle.

Fiscal Year View

Access historical and forward-looking compliance requirements for any year starting from FY 2019.

New FY2025 Fields (Expanded Coverage)

The FY2025 update introduces a significantly expanded field set, giving users a 360-degree view of compliance obligations.

(These fields are fully maintained through AI-driven monitoring of official sources.)

Master File

- MF Deadline

-

MF Deadline Description

Local File

- LF Required to Submit

- LF Deadline

- LF Deadline Description

- Language Required

Country-by-Country Reporting (CbCR)

- CbCR Notification Deadline

- CbCR Notification Deadline Description

- CbCR Notification Portal URL

- CbCR Filing Deadline

- CbCR Filing Deadline Description

- CbCR Exchange Countries

- CbCR Local Filing Requirement

- CbCR Filing Portal URL

TP Form

- TP Form Name

-

TP Form In Place

-

TP Form Filing Portal URL

-

TP Form Description

-

TP Form Deadline

(With TPGenie’s TP Form module, users can generate TP Form data in a single click.)

Statutory Filing

- CIT Return Deadline

-

Corporate Income Tax Rate

Pillar One and Pillar Two

-

Pillar One (Amount B) status including DEMPE

-

Income Inclusion Rule (IIR)

-

Undertaxed Payment Rule (UTPR)

-

Qualified Domestic Minimum Top-up Tax (QDMTT)

-

Transitional Safe Harbour

-

Safe Harbour Status of Enactment

Transfer Pricing Rules – Implementation Timeline

-

Enactment Date

-

Effective Date

Legal Framework

-

TP Legislation

-

TP Guidelines

-

Tax Authority

-

Tax Authority Instructions

BEPS Participation

-

OECD Participation / Membership

-

Global Forum Participation

TP Methods and Documentation Requirements

-

Accepted TP Methods

-

Benchmarking Requirements

-

TP Documentation Requirements

-

Materiality Limits / Thresholds

-

Specific Country Requirements

TP Risk Management

-

TP Audits

-

TP Adjustments

-

Safe Harbours

-

Penalties

TP Controversy

-

Advance Pricing Agreements (APAs)

-

Mutual Agreement Procedure (MAP)

-

Arbitration

Special Transactions

-

Intangibles

-

Intra-Group Services

-

Cost Sharing / Contribution Agreements

-

Intra-Group Financing

-

Business Restructurings

-

Customs Valuation

Detailed Country Compliance Information

Each country includes a complete overview of:

-

jurisdiction and region,

-

entity activity status,

-

number of reports generated,

-

language requirements for documentation,

-

statutory and CIT filing timelines,

-

transfer pricing regulations and safe harbours,

-

Pillar Two implementation details,

-

links to official sources and portals.

The “Country Summary” section can be fully customised to include your organisation’s own transfer pricing policy details. These summaries can be directly inserted into TPGenie reports.

Track Your Compliance Status in Real Time

Beyond monitoring legislation, the Compliance Tracker also records the status of your own deliverables across every jurisdiction. TPGenie automatically updates key fields such as MF Completed, LF Completed, LF Filed, CbCR Notification Filed, CbCR Filed, TP Form Completed/Filed, Statutory Financial Accounts Completed, and CIT Return Filed. This gives you a complete, real-time overview of which reports are prepared, submitted, or outstanding in each country. Combined with automated risk indicators, the system helps you identify gaps early and manage your global compliance workflow with confidence.

Why This Matters

TPGenie provides one of the most comprehensive compliance datasets available in a single platform.

With AI-driven updates, broad country coverage, and deep FY2025 data fields, your compliance team can:

-

stay ahead of legislative changes,

-

maintain accurate, verifiable compliance records,

-

improve audit readiness,

-

reduce risk through early identification of requirements,

-

centralise all global TP and tax compliance obligations.

Schedule a Demo

See how TPGenie simplifies global transfer pricing compliance.

Book a demonstration to explore the AI-driven Compliance Tracker and all its features.